What is Slippage in crypto? | Tips to minimize it

Slippage in crypto trading can significantly impact your returns, often catching traders off guard with unexpected costs. Understanding what slippage is and how to manage it is essential for maximizing your trading performance and minimizing losses.

Before we deep dive, let’s take an example to understand Slippage.

Imagine you booked an Uber from your office to your way back home for $10. Now, due to peak hours, the Uber got stuck in traffic, and you had to pay a total of $15 due to peak hour pricing.

The difference between the expected price and the actual price paid is known as slippage. So in our example, the expected price was $10 while the actual price turned out to be $15. We ended up paying $5 as slippage.

Slippage in Crypto Trading

Let’s look at how slippage occurs in our day-to-day trading in crypto. Slippage is crucial while trading meme tokens or simply buying tokens on DEXs.

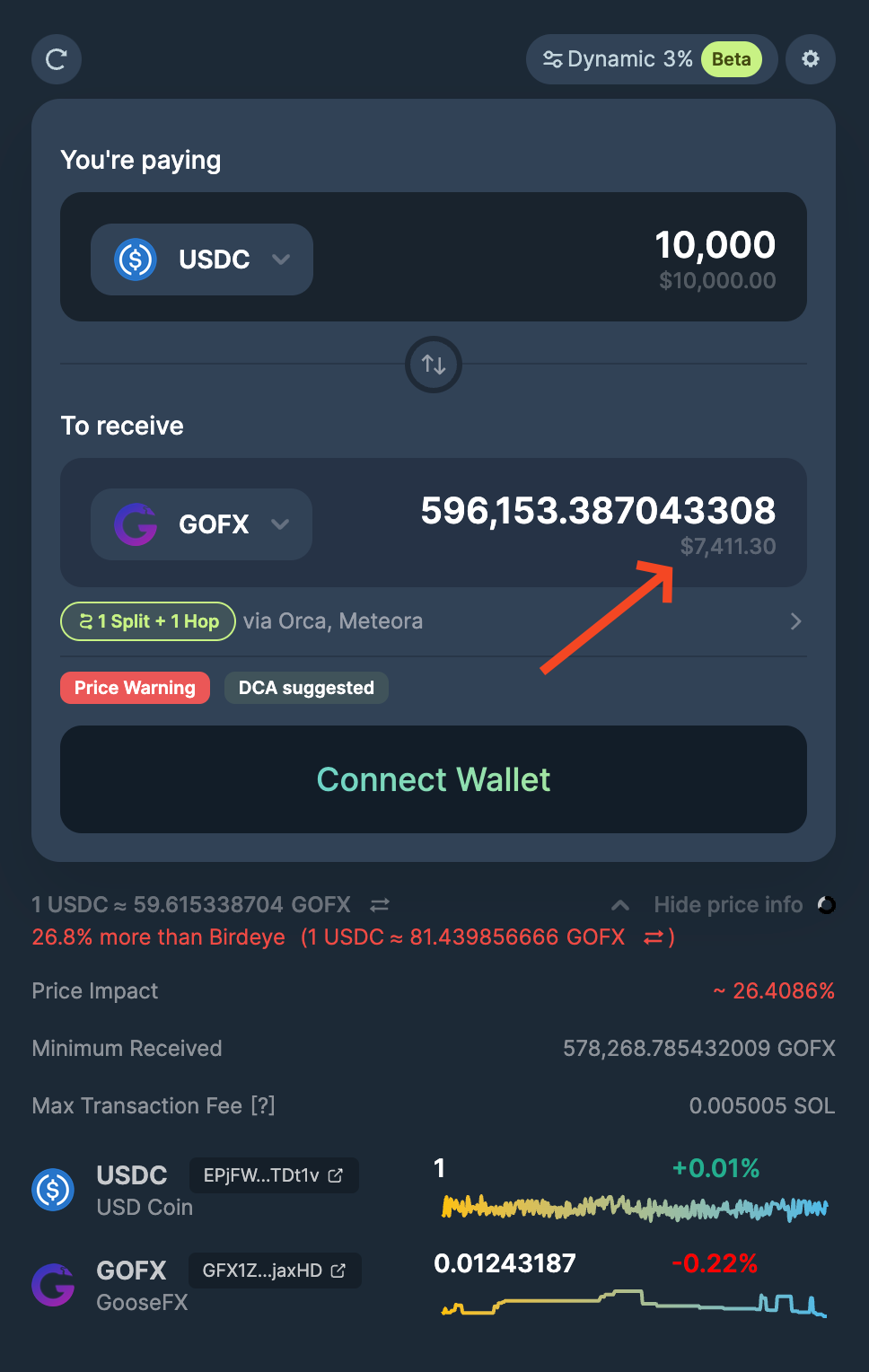

Lets understand slippage by trying to buy $10,000 worth $GOFX token on Solana's most popular DEX Jupiter.

As you can see, by paying $10,000, you are only getting 596,153 $GOFX tokens in return, which at the current market price is valued at $7,411. The difference between the expected price, which is $10k, and the actual value received, $7.4k, is known as slippage.

Causes of Slippage / Types of Slippage

So why does slippage happen in the first place?

- Slippage due to Volatility in Market

- We all know crypto markets are highly volatile, and meme coins are even more volatile. This is where slippage due to market volatility occurs. When the price of the token you are trying to buy/sell keeps changing at a high frequency for more than 1-2%, it causes slippage.

- Example: If you are trying to buy the latest meme coin, as there is a high traffic of buyers every second, the price keeps fluctuating. Hence, the expected price will be different from the actual price.

- Liquidity Slippage

- Every token has a certain amount of liquidity. When trading in large quantities, it’s possible that the order cannot be filled at the current market price due to a lack of liquidity at that price. Hence, to fill the order, there is a change in price, which again is known as slippage.

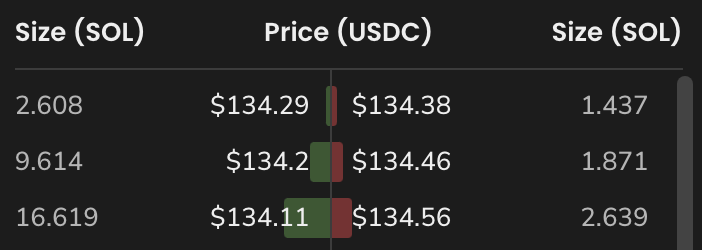

- Example: In the above order book, if you want to buy 3 SOL at the market price of $134.38, there is only 1.437 SOL available. To fill the order, we need to buy at a higher price of $134.46 and then again the remaining at an even higher price of $134.56.

Learn more about what are liquidity pools

- Order size

- The bigger the order size, the larger the slippage. To fill large quantities, liquidity is required at all prices. Even in AMMs, while placing larger orders, to keep the pool adjusted, there is always slippage involved.

How to minimise Slippage?

As we learned how volatile market prices, liquidity, and order size affect slippage, let’s look into how we can minimize the impact of slippage to achieve the best rate possible for our trades.

- Limit Orders

- Limit orders involve setting up your order at your desired price, which will only fill at the exact price you set. If the order fills up 100%, you incur 0% slippage, effectively beating slippage.

- Avoid Trading at Peak Hours

- Trading at peak hours exposes you to higher volatility, increasing the chances of incurring slippage.

- Avoid Volatile Markets

- It’s best to avoid highly volatile assets, as high slippage essentially means incurring an instant loss.

- Spread Large Orders into Small Ones

- To minimize the impact of low liquidity and volatility, it’s best to spread a single large order into multiple small orders.

Final Thoughts

Slippage is an unavoidable part of trading, but by understanding its causes and learning how to minimize it, you can protect your investments and improve your trading performance.

Have you considered how slippage might be affecting your trades? What strategies will you implement to manage slippage better?

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

![Top 6 Chart Patterns for Crypto Trading [Guide]](/content/images/size/w720/2024/07/Top-trading-patterns.png)

Comments ()