What is a DEX? | Top 8 DEXs on Solana

What is a DEX? How do DEXs work? Learn about the Top 8 DEXs on Solana with GooseFX

Table of Contents

- What is a DEX?

- What are the different types of DEXs?

- Advantages of DEXs?

- Risks of using DEXs?

- Top 8 DEXs on Solana

What is a DEX? (Decentralized Exchanges)

A decentralized exchange (DEX) is an application built on blockchains that enables peer-to-peer crypto transactions. The DEX allows traders to trade cryptocurrencies without any centralized financial intermediary. Unlike Centralised Exchanges (CEX), DEXs are non-custodial, meaning the user controls their assets.

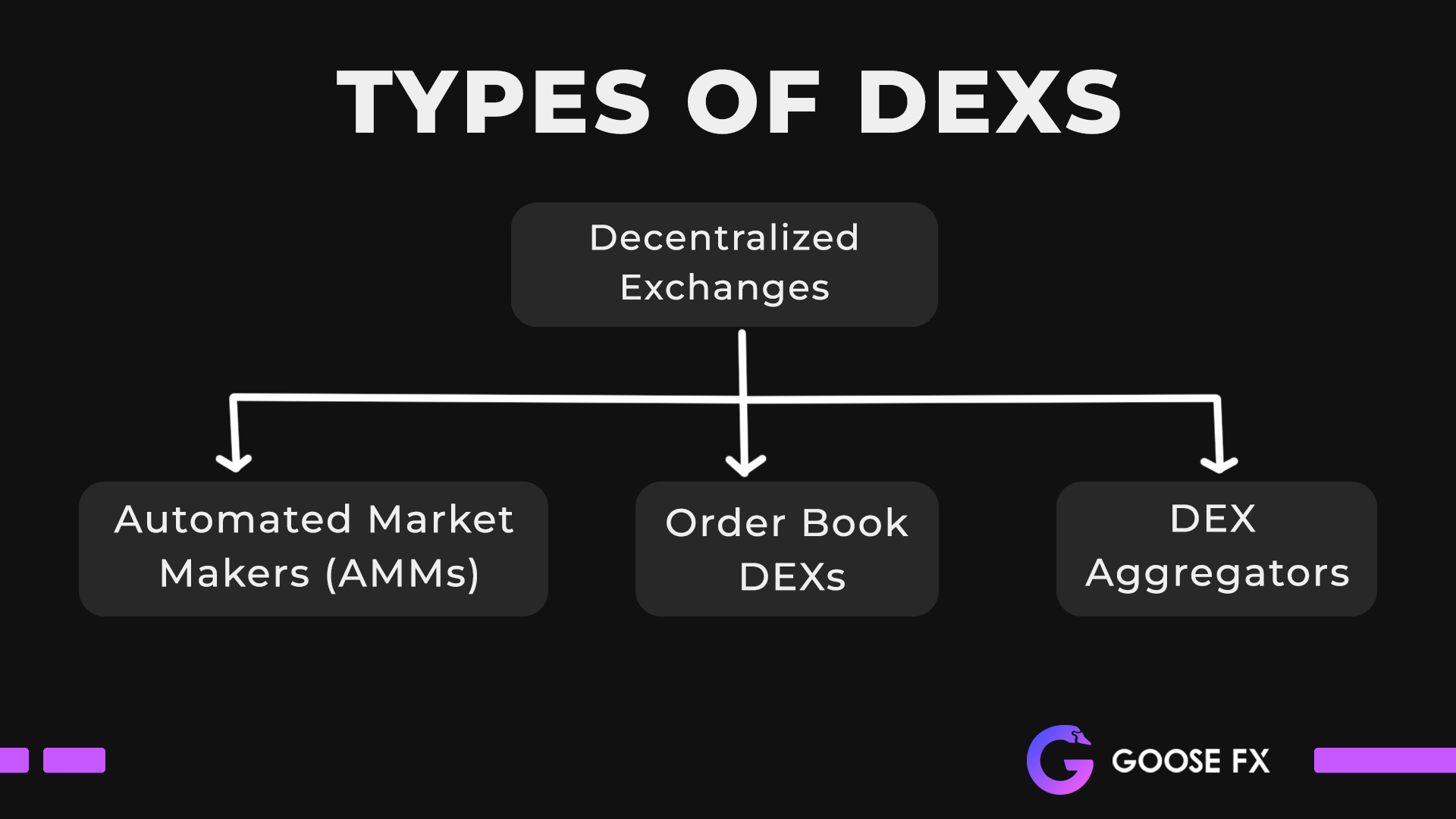

What are the different types of Decentralized Exchanges (DEXs)?

Order Book DEXs

An order book DEX is a list of buy (bid) and sell (offer) orders, including the number of cryptocurrency tokens to be bought or sold. It provides information for every order, such as the total volume of orders at a specific price and the spread between the buy and sell prices. Helping traders to make better and informed decisions. Order book enables buying or selling of crypto tokens at a specified price.

Automated Market Makers (AMMs)

Automated Market Makers (AMMs) allow users to execute trades without relying on buy/sell requests using liquidity pools.

DEX Aggregators

DEX aggregators are protocols that provide access to all DEXs across the blockchain to provide the best prices using a single dashboard.

Advantages of Decentralized Exchanges (DEXs)?

Token Availability

As no regulations specify what tokens can be listed on DEXs, different exchanges may list different tokens. Tokens with larger volumes and liquidity will likely get more attention from the users of a given exchange.

Anonymity

DEXs are becoming more popular because they don't require KYC like CEXs. This allows users to execute trades without disclosing their personal information.

Reduced counterparty risk

Counterparty risk is the probability that one of the parties involved in the trade may default on their obligation. Since assets are directly transferred between digital wallets based on smart contract execution, DEXs aren’t prone to this risk.

Risks of using Decentralized Exchanges (DEXs)?

While most DEXs eliminate centralization and KYC, they’re still vulnerable to risks and exploits in smart contracts used to operate the DEX.

Smart Contract risk

Smart contract risks are the flaws present in the code which can be exploited by an attacker resulting in loss of funds.

Liquidity risk

Liquidity refers to the ease with which one token can be swapped for another. It’s directly proportional to users who pool their assets in the DEXs liquidity pool to facilitate the execution of a trade. If a DEX does not have a significant amount of these liquidity providers, users can not easily trade token pairs, thus negatively impacting trading volume.

Network risk

Since DEXs are built on top of a blockchain, they are bound to issues and failures if the blockchain fails itself.

Token risk

As DEXs allow anyone to create a market for any token online, they have also become a cesspool for malicious tokens and rug pulls.

Why use a DEX?

While Centralized exchanges provide a cleaner UI for any new entrant in this space, DEXs are becoming increasingly popular due to safety concerns. As the name suggests, Decentralized exchanges do not hold your coins in custody, while centralized exchanges do. While this might seem like a big deal, there have been multiple instances where the user was locked out of his account and couldn’t withdraw his funds for an extended period. We recently saw this with the FTX hack, where users couldn’t withdraw their funds, losing their net worth in this catastrophic event. Hence, having custody of your funds at all times is becoming a vital notion more than ever.

Top 8 DEXs on Solana

Aldrin DEX

Aldrin is a decentralized exchange whose mission is to simplify DeFi and create powerful tools to help all traders succeed, leading to more equality.

Aldrin provides a unique CEX-style UI/UX dashboard for all its users with the option to review essential data before executing their trades. The dashboard helps users to find critical token data like official social handles and token analytics.

Buy 👉 Aldrin Token

Aldrin Token Data

Symbol: $RIN

Token Address: E5ndSkaB17Dm7CsD22dvcjfrYSDLCxFcMd6z8ddCk5wp

Raydium DEX

Raydium is an automated market maker (AMM) built on the Solana blockchain which leverages the central order book of the Serum DEX to enable lightning-fast trades, shared liquidity and new features for earning yield.

Raydium's swap feature allows two tokens to be exchanged quickly through Serum, while the DEX UI also allows for more advanced trading features such as limit orders. These make for a better trading experience for users.

Raydium token $RAY holders can use it for governance and performing transactions. It can also be used for utility, where traders who have staked the token and contributed to liquidity pools get $RAY tokens as rewards.

Raydium Token Data

Symbol: $RAY

Token Address: 4k3Dyjzvzp8eMZWUXbBCjEvwSkkk59S5iCNLY3QrkX6R

GooseFX DEX

GooseFX is a full suite of DeFi and NFT protocols built on the Solana blockchain and Serum DEX, offering a variety of unique decentralized peer-to-peer financial products. GooseFX aims to be a complete DeFi experience where you can trade cryptocurrencies, futures, NFTs all through one interface while utilizing your capital across all features seamlessly.

GooseFX DEX will soon allow users to trade perpetual futures on Solana! Imagine going long and short position on your favorite tokens with CEX like experience all on a decentralized platform.

GooseFX is an AMM-based DEX that uses CLMM protocol or Concentrated Liquidity Market Making protocol to provide the best routes and hence the best prices for you to swap.

Buy 👉 GooseFX Token

GooseFX Token Data

Symbol: $GOFX

Token Address: GFX1ZjR2P15tmrSwow6FjyDYcEkoFb4p4gJCpLBjaxHD

Bonfida DEX

Bonfida was one of the earliest projects built on Solana. It is a decentralized non-custodial exchange that is built on the open-source Serum trading protocol, as well as powered by the Solana blockchain. It provides a full product suite that bridges the gap between Serum, Solana, and the growing user base that is actively trading on the Serum DEX.

Apart from being a DEX, they provide web3 domains(.sol) through Solana Name Service and also launched Jabber which is a mobile application for encrypted messaging.

Buy 👉 Bonfida Token

Bonfida Token Data

Symbol: $FIDA

Token Address: EchesyfXePKdLtoiZSL8pBe8Myagyy8ZRqsACNCFGnvp

Orca DEX

Orca is an Automated Market Maker (AMM) running on the Solana blockchain. An AMM is a decentralized exchange that sums up information from other crypto exchanges and platforms and comes up with an average market price for assets. This means that using Orca saves you the time you would have spent comparing the market price for a given trading pair.

Buy 👉 Orca Token

Orca Token Data

Symbol: $ORCA

Token Address: orcaEKTdK7LKz57vaAYr9QeNsVEPfiu6QeMU1kektZE

Jupiter DEX

Jupiter is the key liquidity aggregator for Solana, offering the broadest range of tokens and the best route discovery between any token pair. It provides the most friendly UX for users and the most powerful tools for developers to easily access the best-in-class swap in their application, interface, or on-chain programs.

Prism DEX

PRISM is a dex aggregator powered by Symmetry, formerly known as Symmetry Swap.

PRISM is integrated with liquidity sources across the Solana ecosystem, including Serum, Raydium, Orca, Aldrin & Saber, finding the best routes for users when they’re trading on prism.ag.

Prism Token Data

Symbol: $PRISM

Token Address: PRSMNsEPqhGVCH1TtWiJqPjJyh2cKrLostPZTNy1o5x

DEXLab

Dexlab is a decentralized exchange where users can mint and list SPL tokens. It will provide all the standard DeFi tools and a GUI that facilitates the creation of SPL tokens. Our Minting Lab allows users to manage all aspects of a token and deploy smart contracts that best suit their needs.

Buy 👉 Dexlab Token

Dexlab Token Data

Symbol: $DXL

Token Address: GsNzxJfFn6zQdJGeYsupJWzUAm57Ba7335mfhWvFiE9Z

Subscribe to GooseFX blog for more & comment below

- Do you use any of these DEXs on Solana?

- Which DEX is your favorite among all?

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()