Top 5 DEXs on Solana

In this blog, we'll explore Solana's top DEXs: Jupiter, Orca, Prism, Raydium, Aldrin, and Birdeye. Let's dive in!

Table of contents

Introduction

Another week, another educational blog

Last week, we covered CLMMs and a few DEXs that utilize CLMM based pools so make sure to check that blog out if you haven't already.

If you are unsure as to What DEXs are? , Check out our blog

In this blog, we'll be taking a look at the Top Dexs on Solana in no particular order Jupiter, Orca, Prism, Raydium, Aldrin and Birdeye.

Decentralized Exchanges or DEXs for short, are applications that facilitate peer-to-peer trading without any intermediaries unlike CEXs or Centralized Exchanges.

Most DEXs run on an AMM model as opposed to an orderbook model on traditional exchanges.

Check out our previous blog where we compare AMM and CLOB models

With the basic introduction aside, let's jump into the Top Dexs on Solana!

Top DEXs on Solana

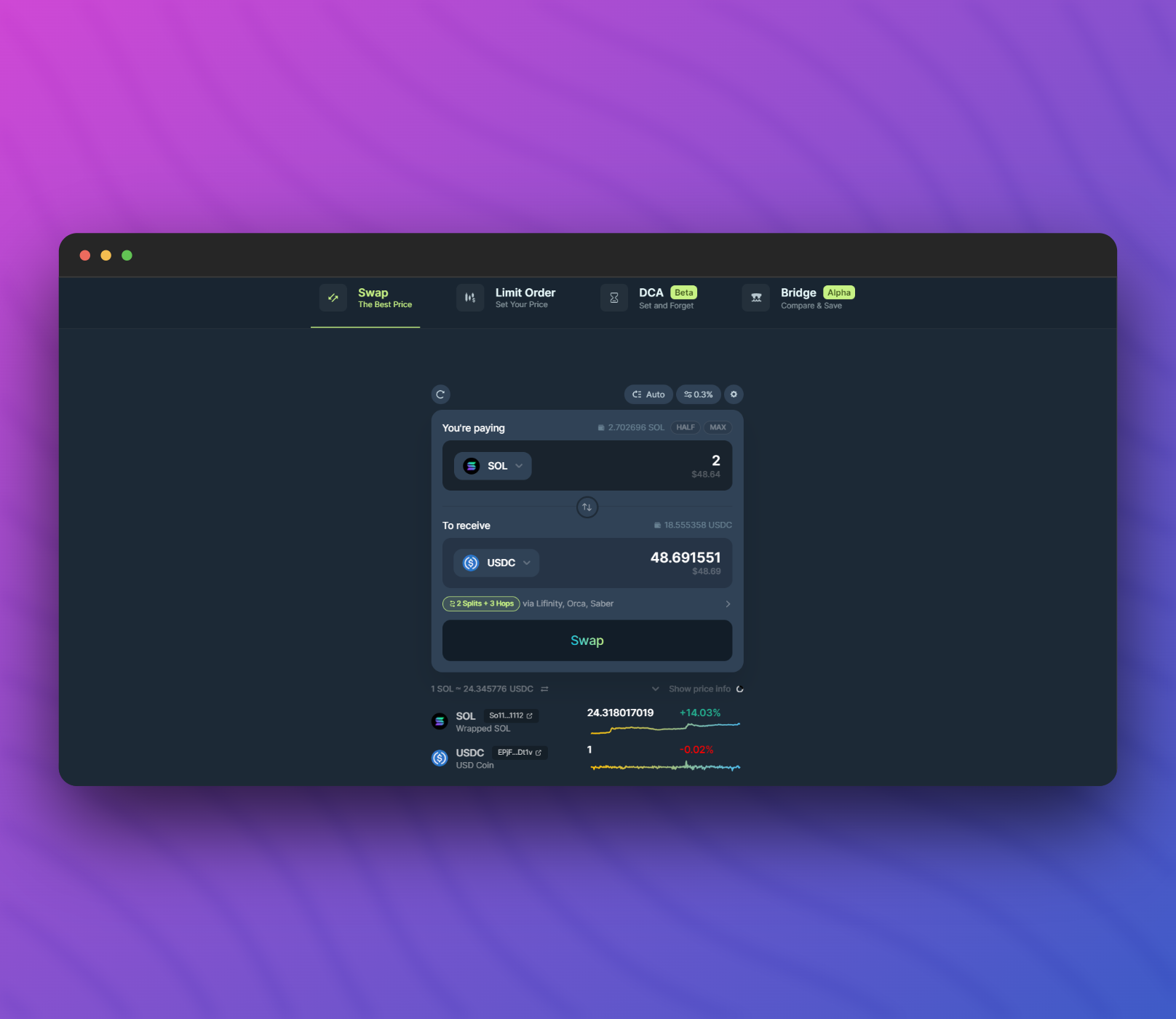

Jupiter

If you've ever done any transaction on Solana, chances are, you may have done it on Jupiter.

Jupiter is the leading Swap Aggregator on Solana that helps you get the best prices for any of your swaps. It serves as a liquidity aggregator, allowing users to access liquidity from various DEXs within the ecosystem. By aggregating liquidity from multiple sources, Jupiter provides users with improved trade execution, reduced slippage, and a seamless trading experience.

Apart from swapping, Jupiter offers various other functionalities including setting Limit Orders, DCA and their most recent offering Bridge - which allows users to bridge their holdings from various other chains like Ethereum, Arbitrum, BNB Chain and many more to Solana.

Check out all the functionalities of Jupiter by visiting their website.

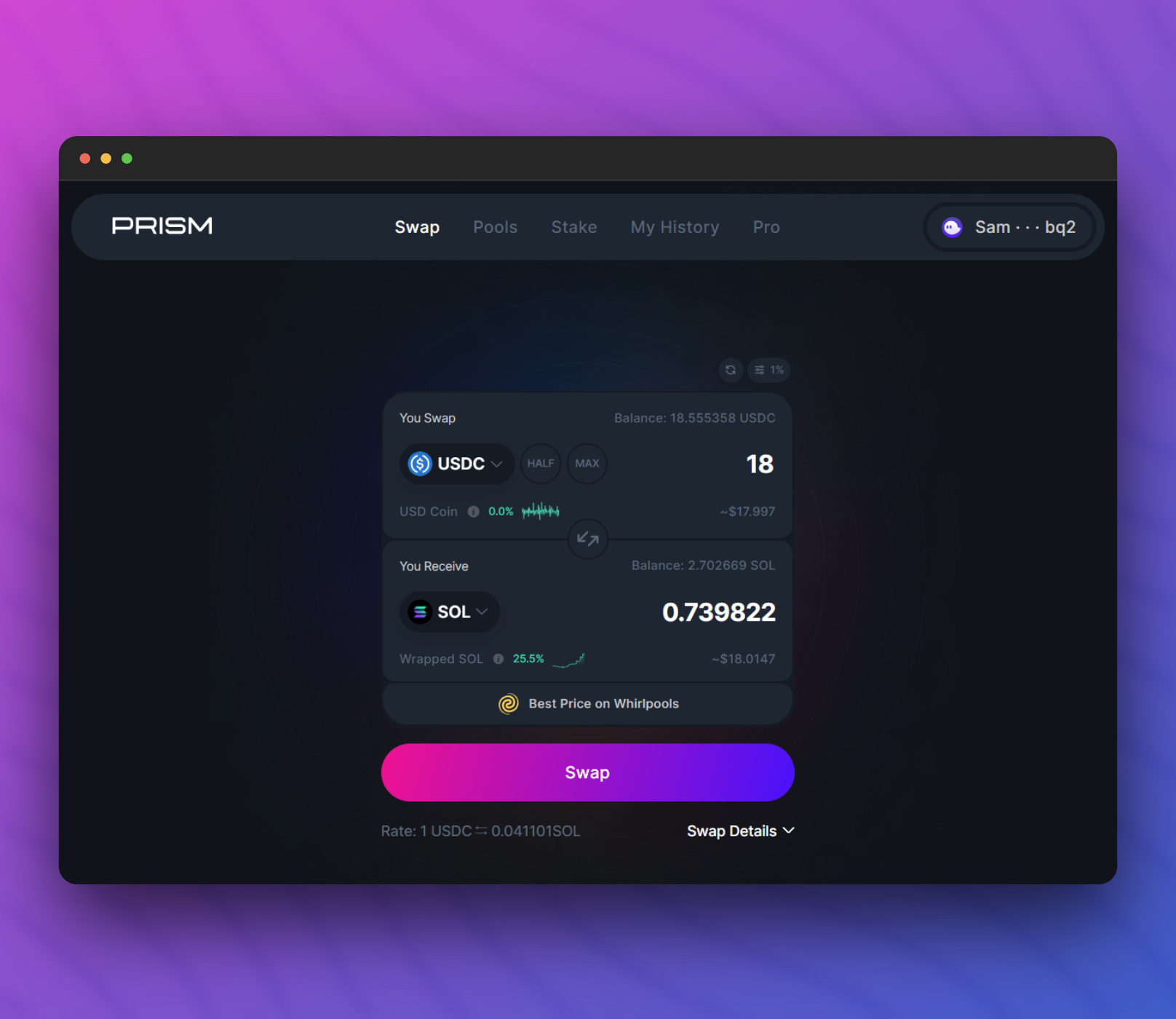

Prism

Next up on our list is Prism which is another Swap Aggregator on Solana. As stated above, Swap Aggregators search various swap routes to provide you with the best possible prices.

On top of providing best routes for your swaps, Prism also hosts other functionalities for you to earn yield on your assets including Pools and Staking your $PRISM tokens.

If you're unsure about what these are, check out our blog where we cover Yield Farming and Staking on Solana

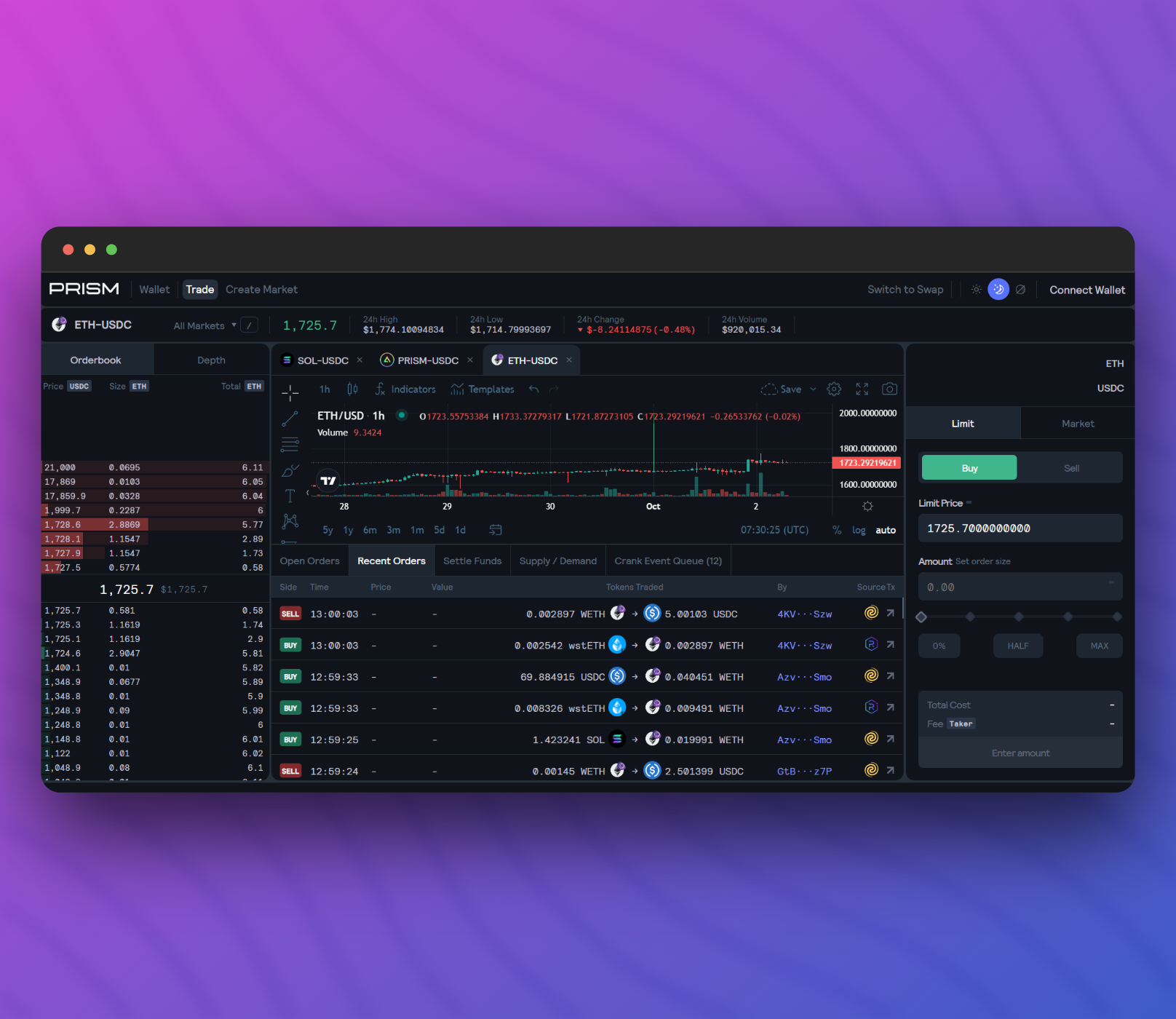

Prism also has a Pro-version which allows users to set Limit Orders. It covers various markets from your blue-chip tokens like SOL, Portal ETH and BONK to memecoins like PEPE, GUAC, SAMO and many more!

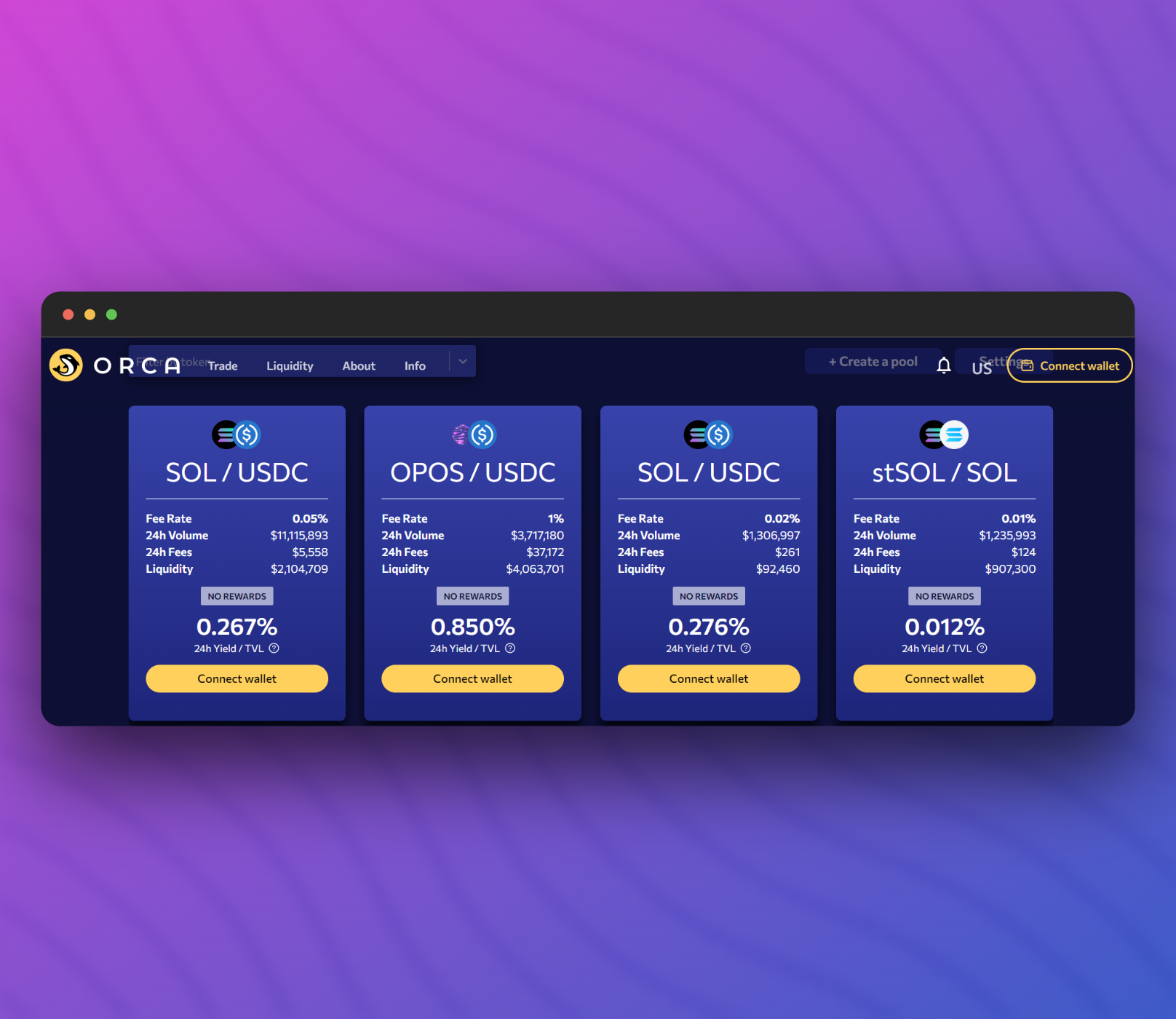

Orca

Moving from Swap Aggregators to AMMs, we got Orca. Orca is the leading CLMM based DEX with a TVL of $43.84 Million. Orca offers a wide range of liquidity pools against which users can swap like SOL-USDC, whETH-USDC and one of the most recent pools being OPOS-USDC.

You can also deposit the assets into their liquidity pools to earn yield on your holdings.

Orca has their native token ORCA which users can hold to participate in their governance.

You can check out orca governance forums in the link attached

Raydium

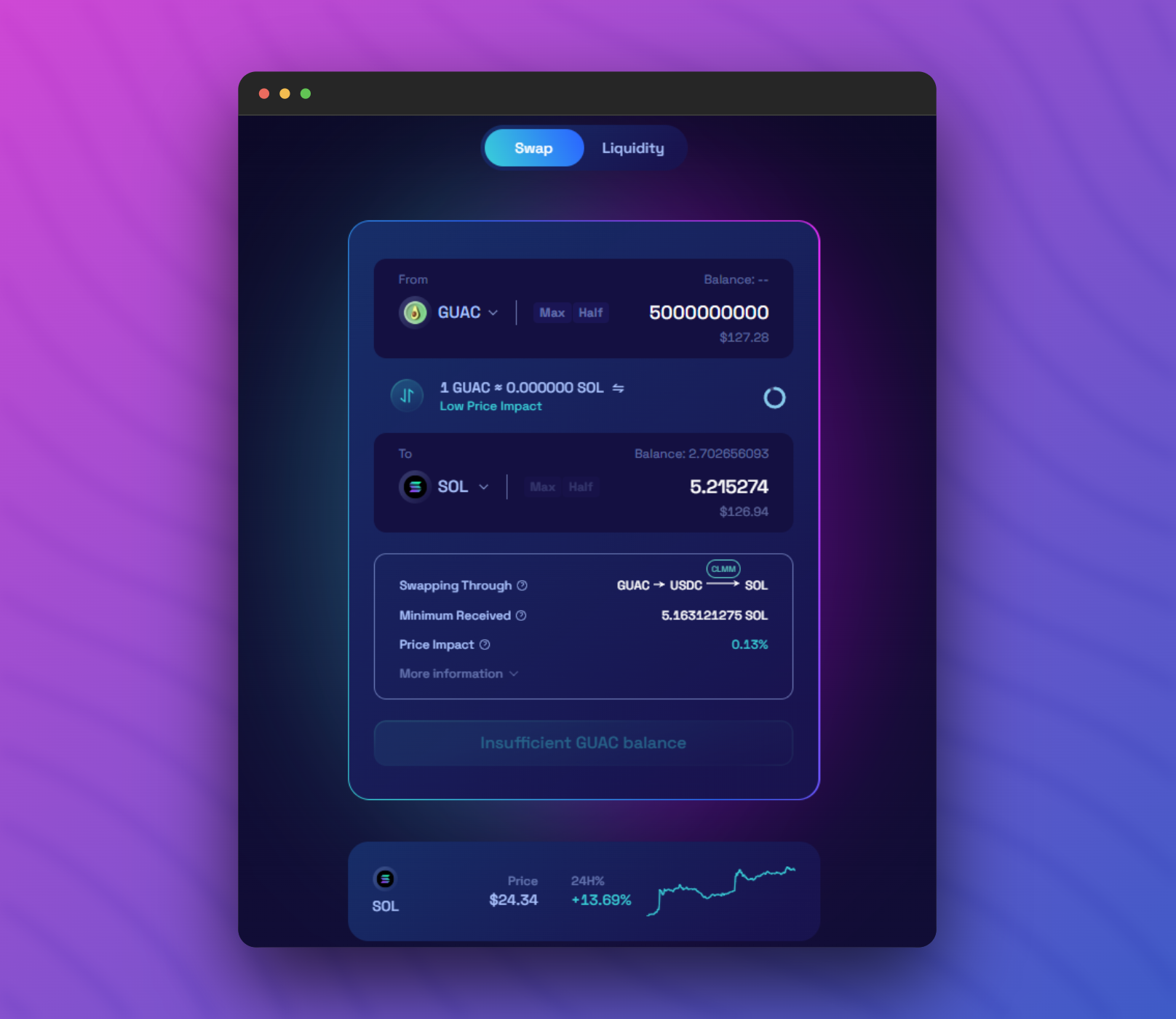

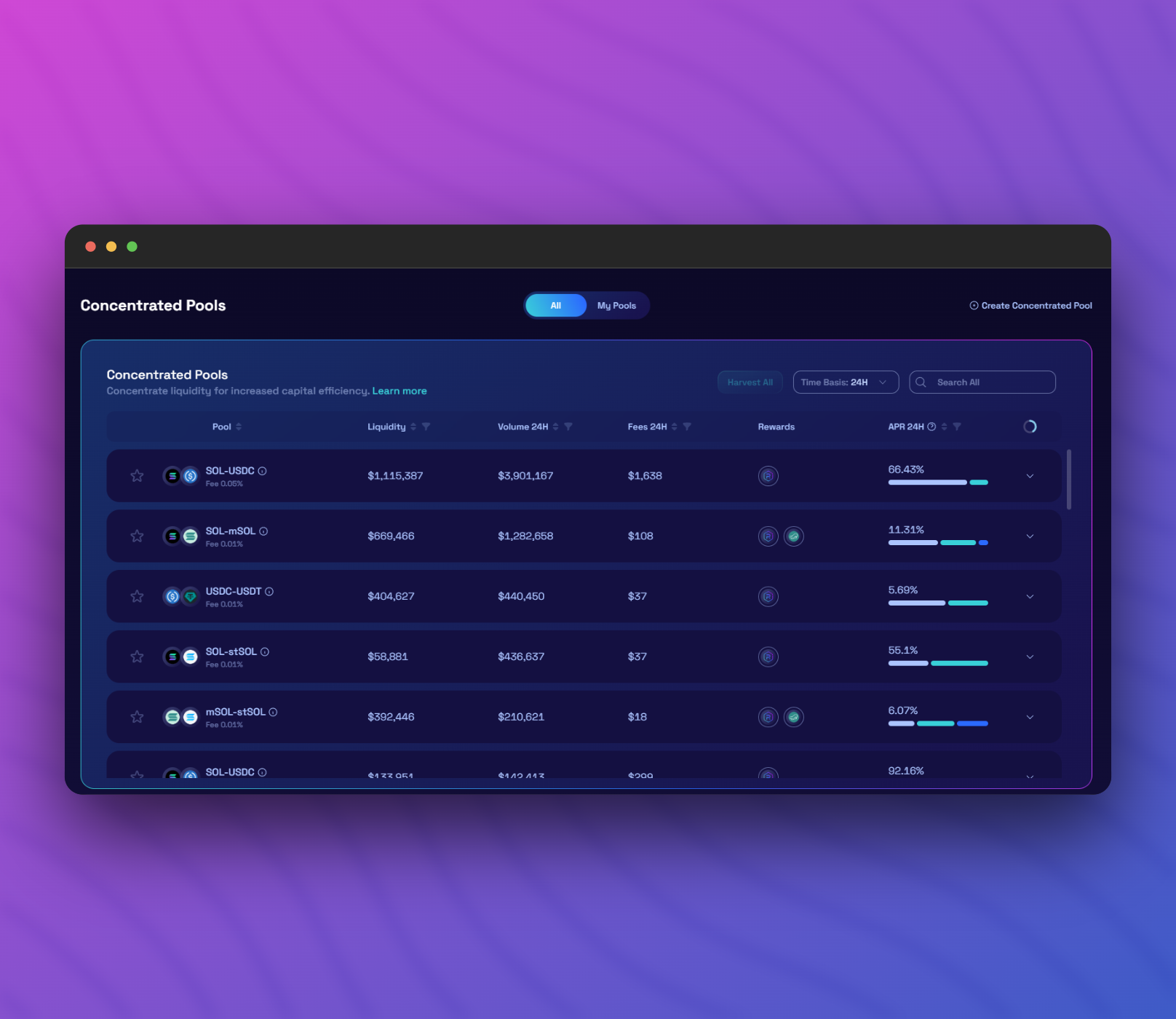

Next up in AMMs we have Raydium. Raydium is another CLMM based DEX on Solana boasting a TVL of $31.2 Million. Similar to Orca, Raydium boasts a wide variety of liquidity pools including your memecoins such as GUAC, PEPE, KING and many more!

You can also provide liquidity either via their Concentrated pools which are based on CLMM model or their other AMM pools.

You can understand the difference between the various pools in Raydium's documentation

Birdeye

Finally, we have Birdeye. Birdeye is not only a dex but primarily a data aggregator that provides users with various information about any token including Price charts, Recent trades, Top traders for that token and much more!

Through their website, you can also swap and put limit orders for any pair that you would like to which is powered by Jupiter.

Birdeye is the only dApps in this list that supports multiple chains and you can also check out information about tokens on various other chains like Ethereum, Arbitrum, BNB Chain and many more! You can also perform swaps on these chains using Birdeye.

To know more about their various other functionalities including Discord and Telegram bot, check out Birdeye's Documentation page!

Special Mention: OpenBook

A noteworthy mention goes out to OpenBook, a pivotal player in the Solana ecosystem over the last few months following the FTX-Saga event.

For the readers who aren't familiar with OpenBook, OpenBook is a community-driven DEX which was forked from Serum v3 after the collapse of FTX.

We've written a full blog covering all the details about Openbook which you can check out

Ending Thoughts

To conclude this blog, we've covered 5 different DEXs on Solana starting from Jupiter which is the leading swap aggregator to Birdeye which is a data aggregator to help traders. We also looked at various other functionalities that these DEXs offer including Limit Orders, Yield farming and much more!

With that, we come to an end to this blog. Hopefully you've learnt something new from it.

Till next time. Happy learning!

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()