Spot vs Perps Trading

Understand the difference between spot and perps trading and learn the best places to trade these on Solana.

Introduction

Cryptocurrency or crypto trading is growing at a massive rate especially perpetual futures or perps trading as is evident by the massive influx of volume across centralized and decentralized exchanges alike.

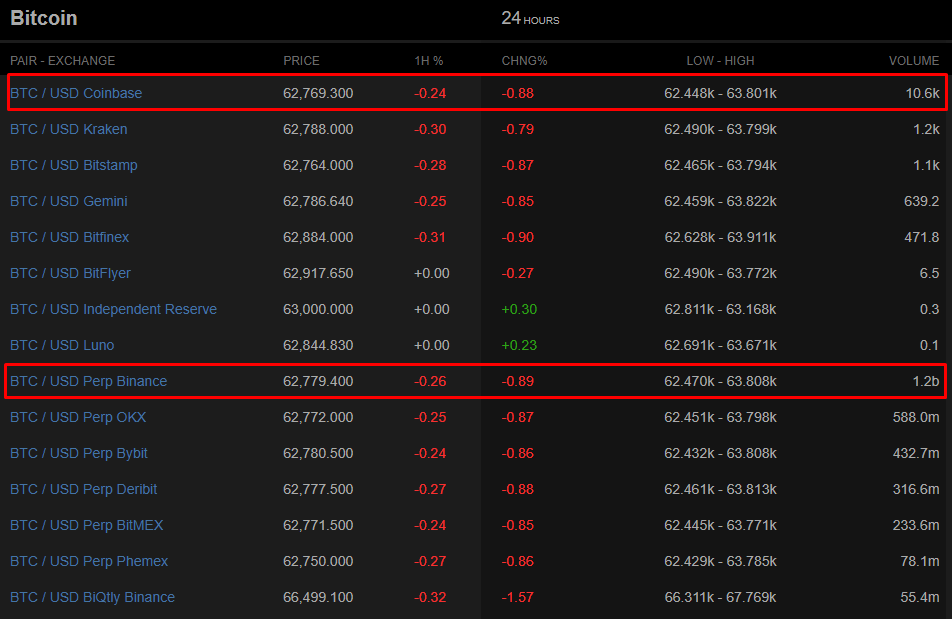

To put this in numbers, we can see that BTC/USDT perps on Binance has done $1.2 Billion in volume in the past 24 hours as opposed to BTC/USD spot on Coinbase which has done only 10.6k BTC contracts which is equal to 10.6k * current price of BTC = $665 Million.

So, in this blog, we'll be going over what does Spot and Perps trading mean, how you can utilize the two and the top places to trade spot or perps on Solana

Without any further ado, let's jump in!

Spot Trading

Spot trading basically refers to buying/selling assets or tokens in this case where you get immediate delivery of the tokens. Every time you swap your assets on Jupiter, you're spot trading.

People utilise spot trading primarily to speculate on price changes of the token. So, if I swap my USDC to SOL, I'm basically buying SOL on spot with the hopes that its prices go up thus making me a profit at the end.

While Spot trading is pretty simple, Perps is where things get a tiny bit more complex but don't worry because Intern shall make this topic crystal clear to you! 😤

Futures trading

To understand perpetual futures or perps, we have to first understand what Futures are and how they differ from spot. Futures are a subset of derivative contracts i.e they derive their value from the underlying asset or token in this case which is nothing but their spot price. These financial instruments allow us to buy/sell a token at a pre-determined price and time thus it's used for future settlement as opposed to immediate settlement in case of Spot trading.

While when trading spot, you can just buy/sell an asset and only profit from it if the price of the asset appreciates, utilising derivatives, you can either long or short the asset potentially profiting off of movements in either direction.

Going long implies that you're betting that the price of the token will increase in the future while going short implies that you're betting that the price of the token will decrease in the future.

Perpetual Futures

In this subset of derivatives, we have Perpetual Futures. Futures come with a pre-determined time but what if we wanted to use them forever without having to settle? That's where Perpetual futures come in, perpetual implying that it goes forever. So, perpetual futures are those contracts that determine their value from the spot price of an asset and aren't settled but go on forever. These contracts are much more widely recognised in crypto as opposed to futures which is evident in the massive volume they pull that we saw previously.

Why were these made in the first place?

For this we need to understand Rolling over in futures. Rolling over means that you close your futures position when it's close to the settlement date and open a similar position in another contract that has a later settlement date. However, this of course involved costs and thus to avoid this, Robert Shiller came up with the idea of perpetual futures.

Terminology

Before, you dive into the world of perps, there are a handful of terms that you must understand so as to make your ride, easier. Those terms are:

- Funding fee

- Leverage

- Margin (Initial and Maintenance)

- Liquidation

- Index and Mark price

Funding Rate

Futures are generally used to either hedge your positions which means taking a position opposite to your current position with the same size to offset any losses due to price fluctuation. However, they are also used by retail traders to speculate on the prices and given that they have settlement dates, these prices converge to spot price the closer we get to the settlement or maturity date.

However, as Perpetuals don't have any settlement date, so in theory they don't have any reason to converge to spot prices right? Well, that's where Funding rates come in. It is a mechanism designed to help keep the price of perps inline with the spot price and is calculated based on the price difference between the Perps price and the spot price.

If the Perps price is higher than the spot price which is generally the case, the funding rate is positive implying that longs pay fees to shorts and if it's negative, then shorts pay fees to longs.

Leverage

Leverage allows traders to borrow capital thus amplifying potential returns or losses. It allows you to increase your position size and could be a boon or a bane depending on how you use it. GooseFX offers up-to 10x leverage on perps which means that you can take a position that is 10 times more than your deposit at max!

We'll be diving into the Do's and don'ts of leverage in a later blog!

Margin (Initial and Maintenance)

The initial margin is the amount you need to deposit to open a position and acts as a collateral for any potential losses if the market goes against you.

If you get liquidated, you lose 100% of your initial margin!

Maintenance margin on the other hand is the minimum balance you must keep to hold an open position. Both of these requirements are determined by the exchange you trade on.

You can find GooseFX's margin requirements in our documentation

Liquidation

Liquidation is the process of automatic closure of a traders' position when the margin balance of the position falls below its maintenance margin. You can avoid this scenario by either practising strict risk management and closing position prior to it hitting the liquidation price or add more collateral to the position.

Intern will be diving in top risk management practices in a thread later so stay tuned! 👀

Index and Mark price

Index price is the fair market value of a token and is calculated by aggregating prices from multiple top-volume exchanges while Mark price is the price based on the order-book of that exchange.

This is the price which by default is used to close your positions or liquidate them to prevent any unfair liquidations.

Trade Spot and Perps on Solana

As mentioned before, Spot trading is basically the same as swapping your tokens and the ideal place for that is Jupiter Exchange on Solana.

- Visit Jupiter Exchange

- Select the token you want to swap and the token you want to receive

- Confirm the transaction and voila! You're done!

We've also made a short tutorial guiding you through Jupiter and their various offerings that you should check out!

For trading perps on Solana, you have multiple choices. We've done an in-depth blog covering top 5 Perps DEXs on Solana which you should check out if you're looking to dip your toes into perps trading.

Conclusion

To conclude, we covered what Spot trading and Perps trading are and how perps which are a sub-category of futures can be utilised. We also looked at a few terms surrounding the world of perps and how you can trade Spot and perps on Solana.

If you're venturing out into the world of perps, it is crucial for you to practice proper risk management and educate yourself about everything related to perps trading before you get started!

Intern out

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()