NFT Valuations: Rarity Scores and Price Discovery in Collections

Navigate the true potential of your digital identity.

We'll dive into the realm of Profile Picture Assets (PFPs) and explore how they impact our digital personas. Get ready to uncover the secrets behind rarity scores and discover the fascinating market dynamics that determine the value of PFP NFTs. So, buckle up as we navigate true potential of our digital identities.

The Digital Frontier: PFPs and Digital Identities

It’s no secret that hordes of users are ready and impatiently waiting to dive into the metaverse headfirst. The physical barriers to entry are almost non-existent with the current state of mobile computing technology. In many cases, users have been interacting with the metaverse through AR applications without even realizing it.

The attraction of immutable ownership and platform transitive property rights in digital environments appeals to many. This is especially true for gamers, who are leading the charge into the unknown, chomping at the bit to stake their claims as first-generation settlers in this new and ever-expanding digital frontier.

A major genre of NFTs that have whipped up tons of hype is the PFP class, or profile picture assets. PFP NFTs provide the holder with easily traceable ownership rights to an image or animation, with which they can establish their own verifiable persona or brand.

Following their minting ceremonies, some projects sit on large treasuries. Many successful projects are converting to DAOs to manage their future development. With DAOs shoring up the legitimacy of these initiatives, coupled with PFP owners building personal brands and reputations on top of their NFTs — and seldom relinquishing ownership of their chosen avatar — some projects have seen amazing price appreciation.

We have been examining this effect on certain NFT collections, and decided a formal study around collection metadata and rarity scores would yield actionable intelligence pointing to the future of the PFP NFT market.

Case Study: Thugbirdz

Let’s take a look at Thugbirdz, a young and popular NFT collection on Solana. We will construct an in-collection multiplicative rarity score and test how well it models relative sale prices within the collection.

Thugbirdz is an NFT collection that was released on August 22, 2021. The supply was 3,333 and the mint price was 1 SOL for the first 1,111 birds, 2 SOL for the next 1,111 birds, and then 3 SOL for the final 1,111 birds. Since then, bid prices have skyrocketed, with several birds selling for over 200 SOL. The floor price currently sits at 64 SOL, which is US$14,586 at the time of writing.

Individual Thugbirdz have different traits, which each have different rarities. 90% of the birds have a normal skin tone, 5% are aliens, and 5% are zombies. 90% of the birds have normal black shades, 5% have red shades, 3% have gold shades, and 2% have cyan tron shades. The birds can also carry other rare traits, such as smoking a cigarette or a blunt, a necklace, piercings, tattoos, and headwear. Thugbirdz also carry nonvisual traits, such as their favorite rapper and position in the gang.

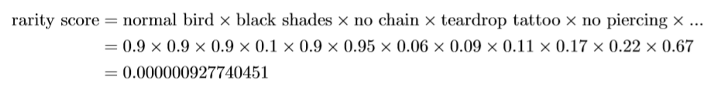

By collecting the rarities of traits from a Thugbird and multiplying the rarities together, we can construct a multipliable rarity score.

For example:

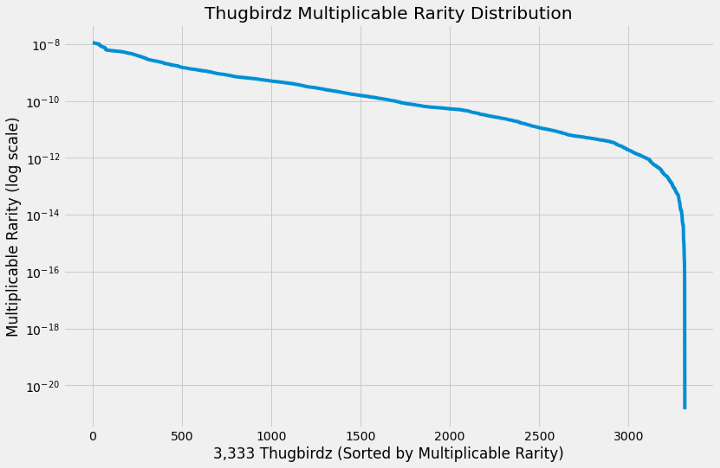

By doing this for all Thugbirdz within the collection, we developed a mathematical measurement that compares rarities of birds. Let’s look at the multiplicable rarity distribution of all 3,333 birds:

Notice how the log multiplicable rarity almost follows a straight line until the rarities really take off for the birds with the most uncommon combinations of traits.

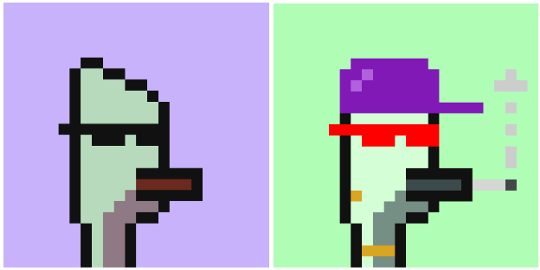

For clarity, let’s also compare the least rare and the rarest of Thugbirdz:

The rarest Thugbird has several extra items, while the most common does not possess any rare traits at all.

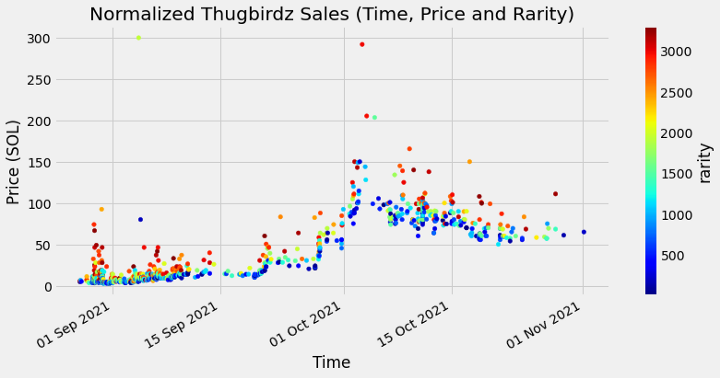

Based on the above data, how do buyers and sellers value rarity? Let’s plot individual Thugbird purchases since the mint event, with the color of each dot representing its rarity ranking. Please note that this chart does not show all Thugbird sales, but only sales from marketplaces where we could obtain on-chain transaction data.

Each dot represents an actual sale of a Thugbird on an NFT marketplace. We notice a clear connection between in-collection rarity and how the bird market places value on the NFTs, where birds with lower rarity rankings are most often sold at the floor price, while rarer birds are sold at higher prices. We also see how there are some exceptions, where not so rare birds get sold at high prices and rare birds are sold close to the floor.

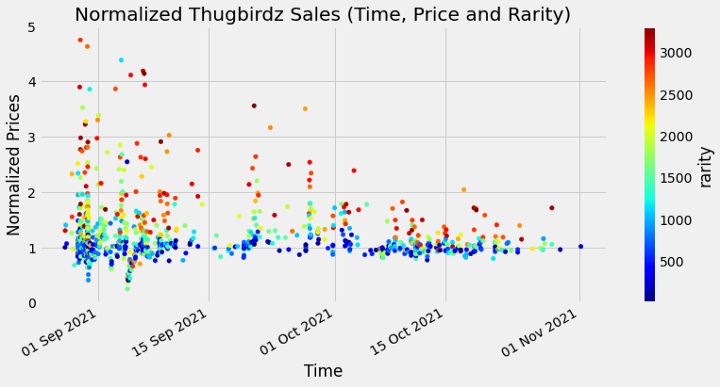

Let’s get a clearer view of the impact of rarity by normalizing the prices. We do this by dividing all sale prices with a rolling exponential mean of the 1,000 least common Thugbirdz:

From this perspective, it becomes clear how well rarity can model relative Thugbird prices. By studying the plots, we can also note how common Thugbirdz have attained higher, impressive prices over time, compared to the rarest of Thugbirdz. This last bit could also be explained by the general decrease of liquidity for NFTs that command higher prices. Or, maybe the owners of rare Thugbirdz just don’t want to sell their birds.

Conclusion: How important is the rarity score to PFP secondary sales?

There are many assumptions that you have to make in the crypto space when attempting to analyze data to gain an edge. At the same time, lots of money is on the line.

- You have to assume there is no price fixing even though there clearly is, as illustrated by the idea of a “price floor” that many projects refer to.

- You must also assume that this data is organic and naturally occuring. However, in some cases, NFT collections were proven to be botted. Some projects may initiate buybacks to purposely throw off models such as this one.

- You should also examine the wallet distribution and resale activity of NFT collections. Also, review sentiment around the minting event to see if it was done fairly.

These are matters that we are still researching across a number of NFT projects. At this point, it is apparent that projects differ considerably, but rarity scores alone can assist with the prediction of PFP resale value. This was the case for Thugbirdz.

At the end of the day, beauty is in the eye of the beholder. If the PFP avatar really speaks to a person, there is no limit to which they will go to purchase that piece.

FAQ Section

Why do people buy an NFT?

People buy NFTs for various reasons. One major factor is the ability to own and collect digital assets that hold sentimental, artistic, or cultural value. NFTs provide a way to establish verifiable ownership of digital creations, such as artwork, music, videos, virtual real estate, and more. Additionally, NFTs offer a potential investment opportunity, with the possibility of value appreciation over time based on market demand and scarcity. NFTs also enable creators to monetize their work directly by selling digital assets and receiving royalties from subsequent sales.

What makes Solana a good platform for NFTs?

Solana offers several advantages, making it an ideal NFTs platform. Its unique architecture and high-speed transaction capability enable near-instant confirmation and minimal latency for minting, buying, and selling NFTs. Solana's low transaction costs, driven by its efficient design and scalability, make it more accessible for creators and collectors. Its scalability ensures the network can handle a high volume of transactions, accommodating the growing demand for NFTs without compromising the user experience.

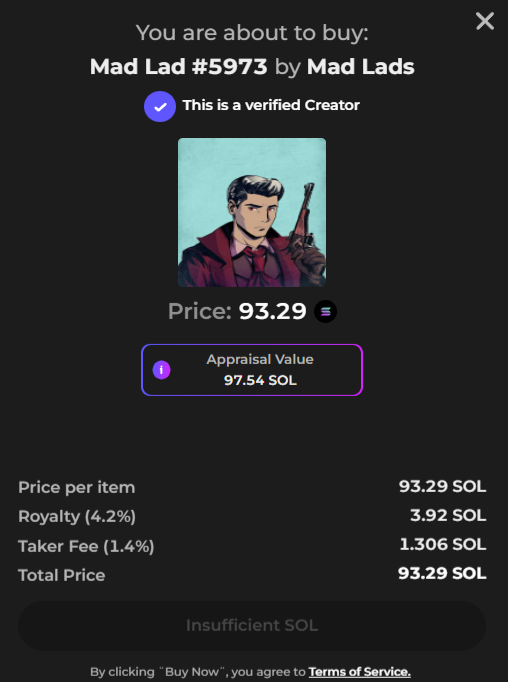

What are the most popular NFTs in Solana right now?

Some of the most popular NFT projects in the Solana ecosystem currently include Rave3NFTs, SMBs (Solana Monkey Business), MadLads, ABC NFTs, and Degen Ape Academy. These projects have gained significant attention and community engagement, offering unique and valuable digital collectibles that have captured the interest of collectors and investors in the Solana NFT market. The vibrant and diverse Solana NFT scene continues to evolve, with new projects emerging regularly to cater to different interests and aesthetics.

What are NFT marketplaces and NFT aggregators?

NFT marketplaces are online platforms where users buy, sell, and trade NFTs. These platforms provide a marketplace for creators to showcase their digital assets and buyers to explore and purchase NFTs. NFT aggregators, on the other hand, are platforms that consolidate NFT listings from multiple marketplaces, making it easier for users to discover and compare NFTs across different platforms.

Trade NFTs on the best NFT Agg 👉 app.goosefx.io/nfts

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()