Maximizing Returns with Solend and GooseFX Perps

Learn how to optimize yield with delta neutral strategies using Solend and GooseFX, Solana's first Super-App. Earn yield while mitigating price fluctuation risks. Start maximizing your returns today!

Introduction

Welcome to another blog discussing another delta-neutral strategy involving your favorite lending protocol - Solend!

If you still need to check out this series's first and second blog, do so!

For those new, Delta neutral is a type of strategy where a user aims to eliminate the directional risk of their portfolio by balancing positive and negative deltas, i.e., staying hedged, resulting in a position less sensitive to market or asset movements.

In this blog, we'll first understand what Solend is and how it works, and then check out how you can utilize them along with our perps exchange to earn yield!

So, without any further ado, let's jump right in!

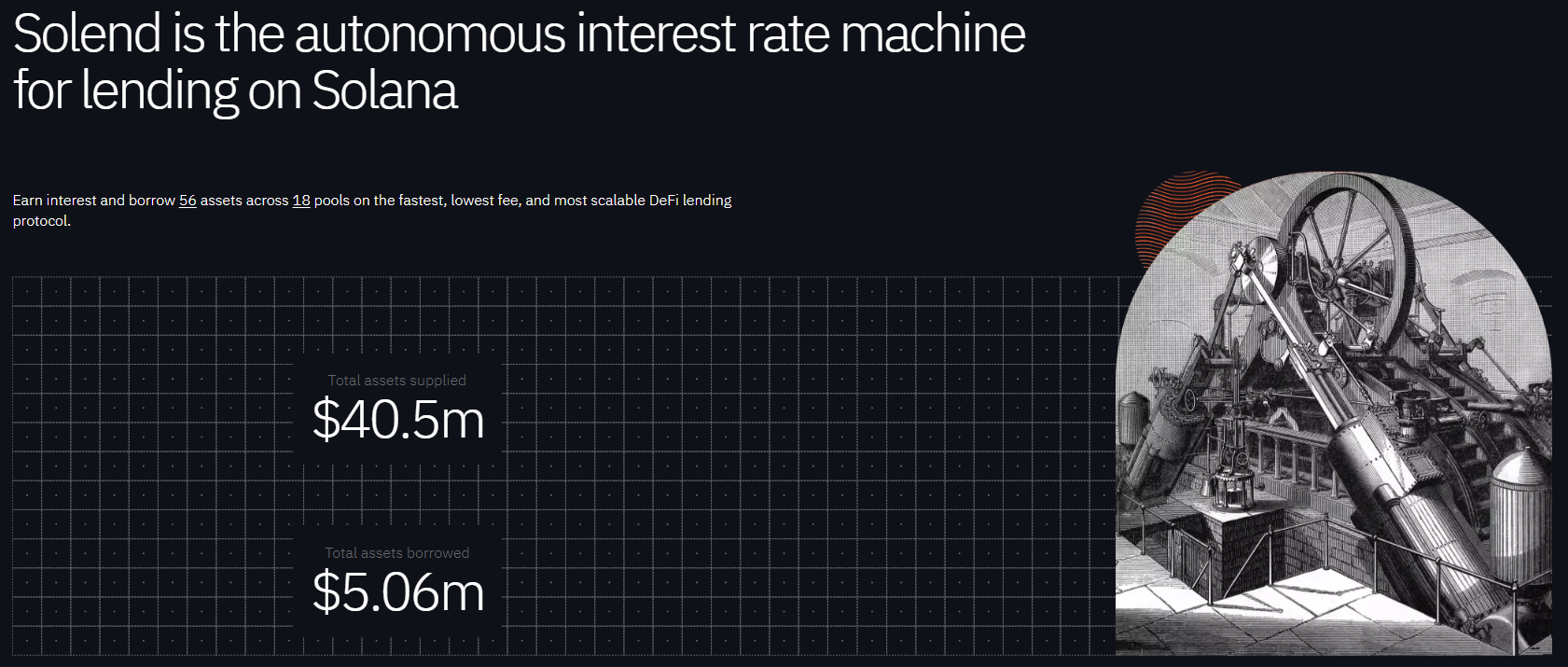

What is Solend?

Solend is a decentralized lending protocol that operates on Solana, allowing users to borrow and lend digital assets like SOL, USDT, USDC, etc., securely and efficiently. At its core, Solend enables users to earn interest on their crypto holdings by lending them to borrowers, while borrowers can leverage their existing assets to obtain loans.

By facilitating these lending and borrowing activities, Solend opens up opportunities for its users, allowing them to put their idle assets to work and access liquidity when needed.

How Does Solend Work?

Solend has multiple layers to its dApps involving Supply and Borrow APY, Liquidation, LTV Ratio, and much more! Let's understand each of them in brief:

Supplying Assets

Users can supply their digital assets to the Solend protocol as loan collateral. These assets can include popular cryptocurrencies such as SOL, USDC, and other supported tokens on Solana.

Visit their docs page, for a step-by-step tutorial.

Borrowing Loans

Once assets are supplied, users can borrow loans by leveraging their collateral. The amount of borrowing power is determined by the collateral's value and the specific loan-to-value (LTV) ratio set by the protocol. The borrowed funds are transferred to the user's wallet, providing them with liquidity.

Repaying Loans

Borrowers are required to repay their loans within a specified period, typically accompanied by accrued interest. Once the loan is fully repaid, the user can withdraw the collateral.

Supply and Borrowing APY

In Solend, users who supply assets can earn an Annual Percentage Yield or APY from borrowers. The borrow APY is split among the entire pool, resulting in the supply APY. The supply APY is calculated based on the borrow APY and the utilization of the pool. APY is given in the same token as the supply, allowing users to earn yields in the deposited token. Borrowers in Solend pay a borrow APY to the pool, and for specific tokens, they can even receive SLND rewards, potentially earning rewards for borrowing.

Solend also offers Liquidity Mining (LM) rewards. Additionally, Solend is running a trial for LM 2.0 involving call options. These options can be claimed and exercised alongside regular LM rewards, offering users additional opportunities to earn rewards based on specific parameters.

By participating in Solend's supply and borrowing activities, users can earn APY on their supplied assets, receive rewards for borrowing, and potentially engage in the LM program to enhance their returns. Solend provides a comprehensive ecosystem for users to maximize their yield potential while utilizing their assets efficiently.

Governance

Solend operates as a decentralized autonomous organization, or DAO for short, allowing token holders to participate in governance decisions. Token holders can propose and vote on changes to the protocol, such as modifying parameters, adding new assets, or upgrading the system. It ensures a community-driven approach to the evolution and development of Solend.

You can check out all the DAO wallets of Solend here

Liquidation

In the event of a borrower's inability to maintain the required collateralization ratio, known as the liquidation threshold, the protocol may liquidate the collateral to protect lenders' funds. The liquidation process involves auctioning off the collateral to the highest bidder, allowing them to purchase the assets at a discounted price and repay the outstanding loan.

Let's dive a bit into understanding the Liquidation process in Solend!

Liquidation Process in Solend

The liquidation process on Solend is triggered when an account's health factor reaches the liquidation threshold, which is determined based on the parameters set for different tokens. The health factor is calculated using the current "Borrow Balance" and "Supply Balance" of the account, obtained from the Pyth and Switchboard oracles. When the health factor reaches the liquidation threshold, the account becomes open to liquidation.

Third-Party Liquidators repay 20% of the borrower's loans by selling an equivalent amount of collateral during liquidation. In return, the liquidators receive a 5% bounty on the liquidated amount as a security measure for the protocol. This process ensures the protocol's stability and protects the lenders' interests.

To learn more about becoming a liquidator, additional information can be found in Solend's docs.

The liquidation mechanism on Solend serves as a safeguard to maintain the health and integrity of the protocol while offering opportunities for third-party participation in securing the ecosystem.

For all details regarding their liquidation process, check out their docs page.

Now, with all the basics of Solend out of the way, let us understand how we can use Solend with our perps dex and create a simple delta neutral strategy!

So, how do I utilize Solend with GooseFX?

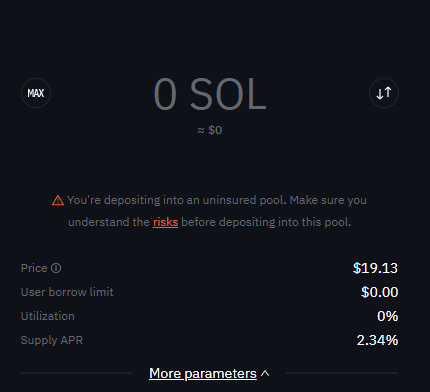

Imagine a person named Footer with 1000 USDC that he wants to use and earn a yield on. He checks Solend Protocol and sees that the Supply APY, i.e., the APY that he will get for supplying SOL, is 2.34% (Hypothetical example)

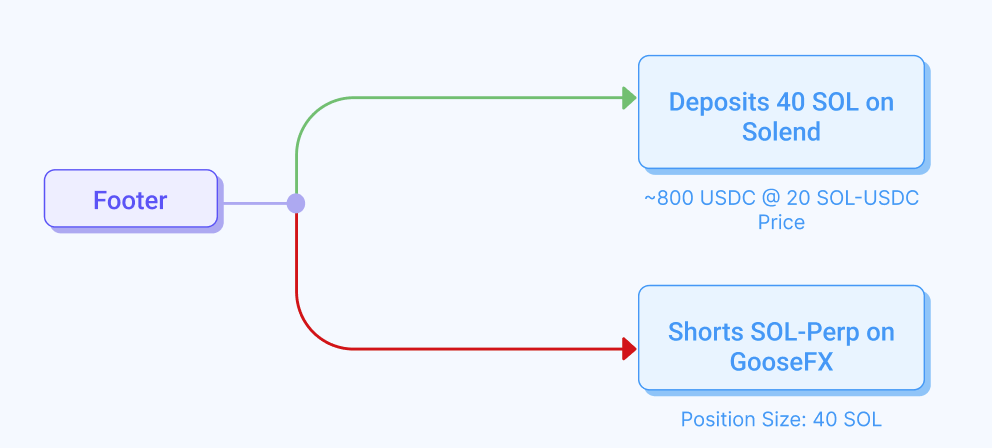

So, he converts 800 USDC into equivalent SOL, assuming a price of 20 USDC per SOL, Footer gets 40 SOL. Now, Footer deposits his 40 SOL into the SOL pool; however, he realizes that until his SOL is in the pool, prices of SOL could fluctuate, resulting in either a net loss or an additional profit if prices go down or up, respectively.

To protect himself from price fluctuation losses, Footer needs to go short SOL with the same notional size as his SOL locked in the Solend pool, i.e., 80 SOL. Going short implies that Footer will make a profit if the price of SOL goes down and lose if the price of SOL goes up in the future.

To do this, Footer visits GooseFX and deposits his leftover 200 USDC into the perps dex. GooseFX allows a maximum of 10x leverage and so Footer can utilize his 200 USDC to create a maximum position size of 2000 USDC!

However, Footer only wants to protect himself from price fluctuation risk so he goes Short with a position size of 40 SOL or 800 USDC.

Note: Footer's initial effective leverage is hence 800/200 or 4x while his maximum leverage is 10x.

How does this help Footer?

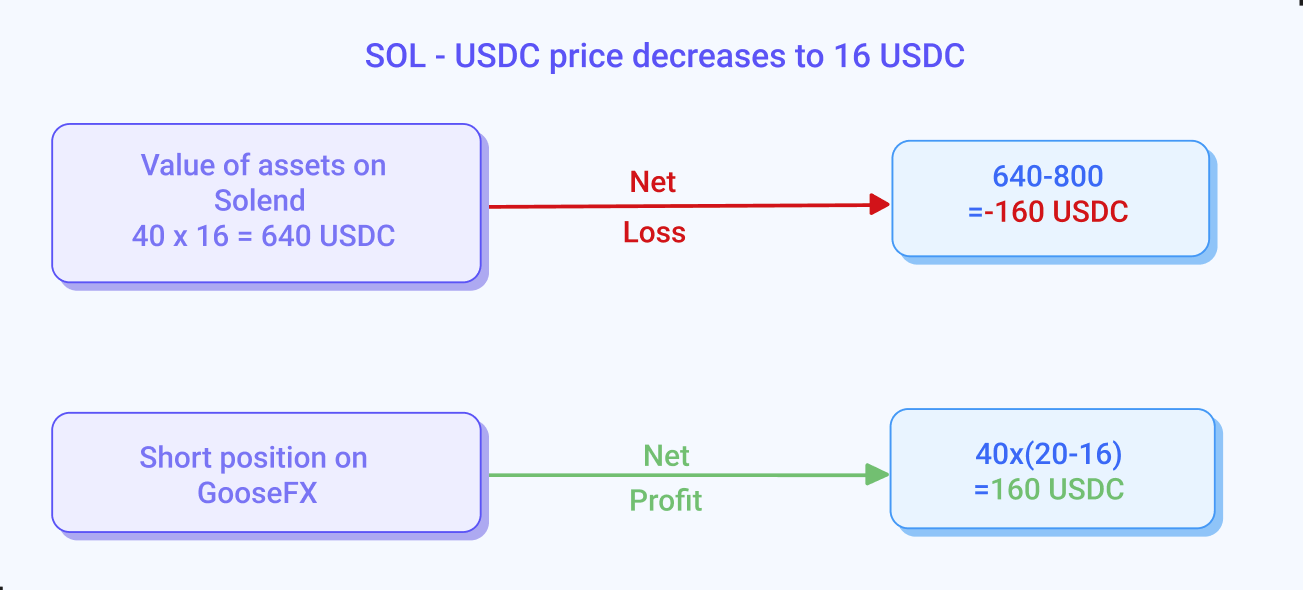

Let's say that price of SOL after a month is 16 USDC. Hence, the 40 SOL that Footer has lent is worth 640 USDC, only netting him an 800-640 = 160 USDC loss!

However, Footer was also short SOL on GooseFX and since price of SOL went down, he would have made a profit of 40*(20-16 USDC) = 160 USDC! Thus Footer has neutralized his losses making it a price risk free trade, while still capitalizing on the APY generated in the SOL Pool!

What if price of SOL went up during this period?

Footer would have thus made a profit on the SOL locked in the pool which would be negated by the loss on his short position.

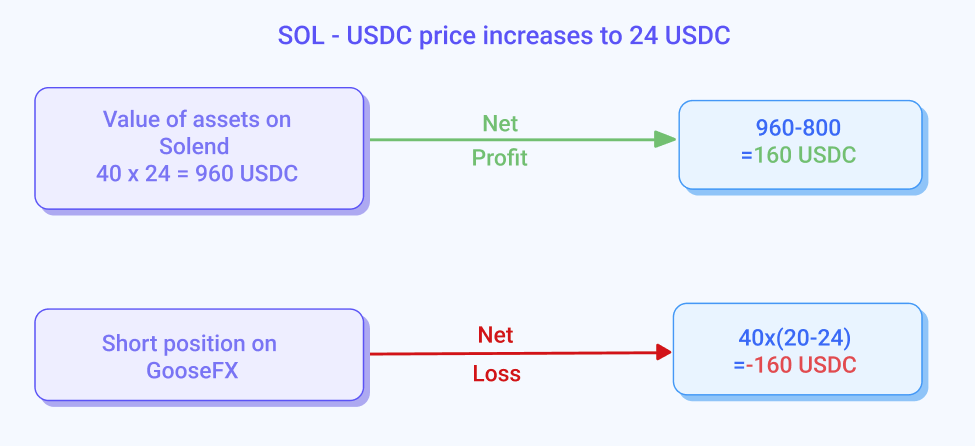

Assuming if price of SOL went up to 24 USDC. Hence Footer's 40 SOL position would be worth 960 USDC netting him a 960-800 = 160 USDC profit!

However, Footer's short position on GooseFX would result in a loss of 40*(20-24 USDC) = 160 USDC loss!

While, in theory, the trade sounds like an ideal plan to capitalize on and put your assets into generating a sustainable yield, it's not all sunshine and rainbows!

Funding Rates

While trading on any perpetual futures exchange, you'll encounter Funding Rates. These are the periodic fees charged to traders to help the price of perpetual futures converge with the spot prices of its underlying asset.

You can read all about Funding Rates in our blog here.

A positive funding rate would imply that Longs pay Shorts and vice versa for negative funding rates.

Let's assume that the Funding Rates throughout this period were favorable on our platform, implying that Footer, who is short every hour, will receive periodic payments from long people.

At the time of writing Hourly Funding Rate on SOL-Perp on GooseFX is at 0.050%, i.e., every hour, longs pay shorts, 0.05% of their position, and hence in Footer's case, it would be 0.05% * 800 USDC = 0.4 USDC every hour. Thus, if the funding rates stay constant, he would earn 0.4 USDC*24*30 = 288 USDC in 1 month on his short position on top of the interest earned via his Solend position!

What if the Hourly Funding Rates were negative 0.05%? For Footer the total payments he would have done over a period of 1 month would then be 288 USDC reducing his overall profits of his Solend Position!

Hence, Footer (and you) should be aware of Funding Rates at all times to evaluate the yield on this strategy carefully!

Also note that Funding Rates can change over time as it is nothing but the difference between the Perpetual price and the Spot price of that asset, thus further increasing or decreasing Footer's profits over time.

Frequently Asked Questions about Solend (FAQs)

Is Solend owned by Solana?

No, Solend is not owned by Solana. Solend is an independent lending protocol built on Solana. It leverages the capabilities of the Solana network to provide efficient and decentralized lending services.

What is the difference between Solend and Solana?

Solend is a lending protocol that operates on Solana. Solana, on the other hand, is a high-performance blockchain platform that enables fast and scalable decentralized applications or dApps. While Solend is one of the projects built on Solana, Solana itself is a broader blockchain ecosystem hosting various applications and protocols.

What is the Solend protocol?

Solend protocol is a decentralized lending platform built on Solana. It allows users to borrow and lend digital assets permissionless and trustless. Using smart contracts, Solend facilitates lending without intermediaries, offering users opportunities to earn interest on their idle assets or access capital by collateralizing their holdings.

How does Solend work?

Solend connects lenders and borrowers directly through smart contracts on Solana. Lenders can deposit their digital assets into liquidity pools, making them available for borrowers to borrow against. Borrowers can collateralize their assets and borrow funds based on the collateral's value. The supply and demand dynamics of the platform determine the interest rates. Borrowers must maintain a certain collateralization ratio, and if it falls below the threshold, the liquidation process is triggered to protect lenders' funds.

Conclusion

In this blog, we explored Solend, a decentralized lending protocol on Solana, and how it enables users to earn interest by lending and borrowing assets. We also discussed the supply and borrowing process, APY for lenders and borrowers, liquidity mining rewards, and the importance of governance and the liquidation mechanism of Solend Protocol.

We also examined how Solend can be used in conjunction with GooseFX's perps DEX to create a delta neutral strategy, protecting against price fluctuations while capitalizing on APY. However, it's important to consider factors like funding rates and market conditions when implementing this strategy.

By understanding Solend and leveraging the features of GooseFX, users can optimize their yield potential and make informed decisions in the dynamic world of decentralized finance.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()