Leverage - Myths and Misconceptions

Unlock the power of leverage trading! Our blog debunks myths, reveals it's risks and rewards, and guides you to maximize its potential!

Introduction

Leverage in trading is a tool that allows traders to borrow funds to increase their trading position size. It can be an attractive option for traders seeking to capitalize on market opportunities and maximize profits.

However, leveraging also comes with its fair share of myths and misconceptions that can misguide traders and potentially lead to significant losses.

This blog will explore some common myths and misconceptions surrounding Leverage in cryptocurrency trading. By debunking these misconceptions, we aim to provide traders with a clearer understanding of how Leverage truly works and empower them to make informed decisions in their trading strategies.

Leverage should not be used as a gambling tool in the current market conditions to strike a single highly profitable trade. It is essential to approach Leverage cautiously and dispel any false beliefs that may lead to unnecessary risks or unrealistic expectations.

Let's begin this blog by addressing the first Myth: The belief that high Leverage is always beneficial.

Myth #1: High Leverage is Always Beneficial

The first misconception among traders is the belief that high Leverage is always advantageous and guarantees higher profits. This misconception stems from the idea that the higher the Leverage, the greater the potential returns. While this is true, it's crucial to understand that high Leverage carries its own risks and may not always result in favorable outcomes.

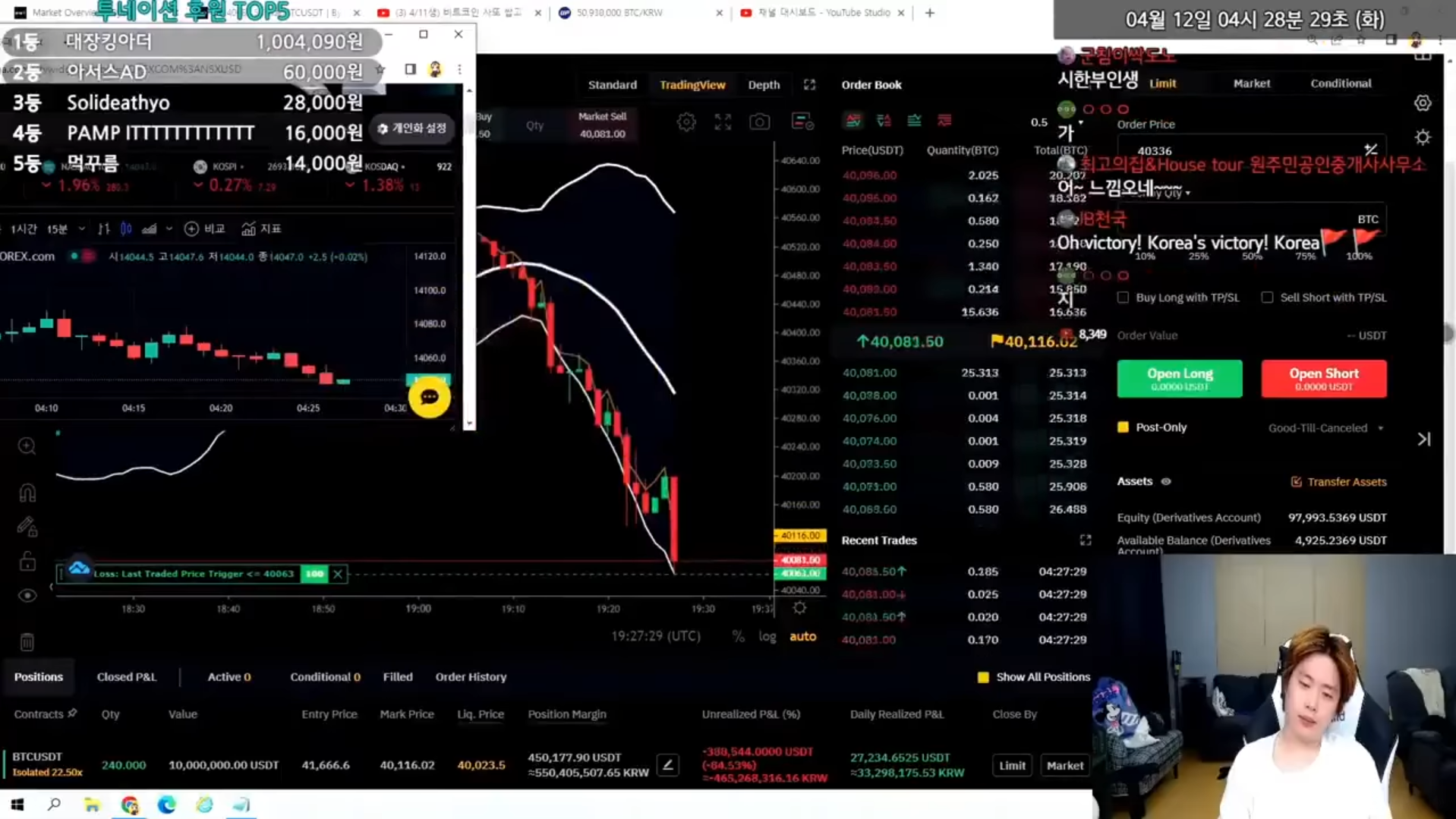

While high Leverage can amplify potential gains, it also magnifies losses in the same proportion. It means that even a small adverse price movement can lead to significant losses, potentially wiping out the trader's entire capital.

It's important to remember that Leverage is a double-edged sword that can enhance both profits and losses.

Moreover, trading with high Leverage requires precise risk management and a thorough understanding of market dynamics. Traders must be skilled in executing their strategies and closely monitor their positions. Failing to do so can expose them to heightened risks and lead to substantial financial losses.

It is advisable to approach Leverage cautiously and carefully assess the risk-reward ratio.

We've written another article on Risk Reward Ratio and Expected Value that you can check out here

It's essential to strike a balance between leverage and risk tolerance, considering one's trading experience, financial situation, and market conditions.

Myth #2: Leverage Guarantees Quick Riches

Another prevalent myth surrounding Leverage is the belief that it guarantees quick riches in cryptocurrency trading. This Myth is connected to the previous Myth leading many traders to believe that they can multiply their gains exponentially in a short period using Leverage. However, it's essential to debunk this Myth and understand the realities of leveraging.

Trading with high Leverage without a solid strategy and risk management plan can lead to substantial losses and financial ruin. The crypto markets are known for its volatility; price fluctuations can be unpredictable and swift.

It's crucial to approach leveraging with a realistic mindset and understand that trading involves inherent risks. Profits are never guaranteed, and losses can occur just as easily. Successful trading requires a comprehensive understanding of market trends, technical analysis, and risk assessment. It also demands discipline, patience, and the ability to make informed decisions based on careful analysis rather than impulsive actions.

Myth #3: Leverage is Suitable for All Traders

Another common misconception about Leverage is that it suits all traders, regardless of their experience, knowledge, or risk tolerance. While this is true to some extent, this Myth often leads traders to adopt Leverage without fully understanding the implications and consequences.

In reality, Leverage is a tool that should be approached cautiously and used according to an individual's trading capabilities and risk appetite. It's crucial to assess whether Leverage aligns with your trading goals, risk tolerance, and experience level.

Novice traders or those new to the markets may find it particularly risky to engage in leveraged trading. A lack of experience and understanding of market dynamics can lead to poor decision-making, increased emotional trading, and significant losses. Therefore, It's advisable for new traders to gain a solid foundation in basic trading principles and gradually increase their exposure to Leverage as they become more comfortable and knowledgeable.

Even experienced traders need to exercise caution when utilizing Leverage. It's essential to have a clear risk management strategy and adhere to it strictly.

Additionally, it's important to consider the specific market conditions and volatility when deciding whether to employ Leverage. Highly volatile periods can result in rapid price swings and increased risk exposure. Traders should evaluate market trends, news events, and technical indicators to make informed decisions about leverage usage.

Myth #4: Leverage is always risky

Another common misconception about Leverage is that it is always risky and should be avoided at all costs. While it is true that Leverage amplifies both gains and losses, it does not automatically mean that Leverage is inherently risky. Leverage's risk level depends on how it is used and the risk management strategies implemented.

Leverage can lead to substantial losses when used irresponsibly or without proper risk management. However, when employed judiciously and disciplined, Leverage can be a valuable tool in trading and investing. Traders who understand the risks involved and implement risk management techniques can mitigate potential losses and increase their chances of success.

To effectively manage the risks associated with Leverage, traders should establish clear risk management strategies, set stop-loss orders to limit potential losses, diversify their portfolios, and continuously monitor market conditions. By doing so, they can minimize the inherent risks and make informed decisions based on their risk appetite and trading goals.

Myth #5: Leverage is only for speculative trading

Another misconception surrounding Leverage is that it is solely meant for speculative trading, where traders aim for short-term gains based on market volatility. While Leverage can be used for speculative purposes, it is not limited to such trading strategies alone.

Leverage can be a risk management tool, particularly for hedging purposes. Traders can use Leverage to establish offsetting positions or hedge against market movements that may adversely affect their existing positions. It helps to mitigate potential losses and safeguard their portfolios in uncertain market conditions.

Leverage can be employed in various trading and investing approaches, including long-term investment and risk management techniques. It allows traders and investors to optimize their capital efficiency, enhance portfolio diversification, and seize opportunities that align with their trading objectives.

For long-term investors, Leverage can be utilized to magnify the returns on their investments over an extended period. By carefully selecting fundamentally strong assets and using Leverage wisely, investors can amplify their gains and accelerate the growth of their portfolios.

Myth #6: Leverage is synonymous with gambling

The last prevalent misconception about Leverage is that it is synonymous with gambling. Some believe using Leverage in trading is equivalent to taking reckless bets or relying solely on luck. However, this perception oversimplifies the nature of leveraging and undermines its strategic implementation in trading.

Unlike gambling, where outcomes are predominantly based on chance, leveraging allows traders to capitalize on market inefficiencies, trends, and patterns. Traders who utilize Leverage effectively implement robust risk management strategies set realistic profit targets, and employ appropriate position-sizing techniques.

Many of the abovementioned misconceptions arise from inadequate risk management, improper position sizing, and emotional trading. By effectively managing these factors, you can navigate the challenges associated with Leverage and uncover its positive aspects quickly.

FAQs (Frequently Asked Questions)

- What is Leverage in trading?

Leverage in trading refers to borrowing funds from a broker or exchange to magnify the potential returns of an investment. It allows traders to control a larger position in the market with a smaller amount of capital. - How does Leverage work?

Leverage uses borrowed funds to open larger positions than the trader's available capital. It is typically expressed as a ratio, such as 1:10 or 1:100, indicating how much capital a trader can control compared to their initial investment. However, it's important to note that while Leverage amplifies potential profits, it also amplifies potential losses. - What are the common mistakes traders make when using Leverage? Common mistakes traders make when using Leverage include Overleveraging, Not understanding the risks involved, Neglecting risk management practices, Letting emotions drive trading decisions.

- What resources can I use to learn about Leverage and risk management?

Various educational resources are available to learn more about Leverage and risk management in trading. These include online courses, tutorials, books, and reputable trading platforms that offer educational materials. Investing time in learning and continually enhancing trading skills is essential to mitigate risks associated with Leverage.

A good beginner source to learn Risk Management is this video from CryptoCred

Conclusion

In conclusion, we have explored various myths and misconceptions surrounding Leverage in trading. By debunking these myths, we have gained a clearer understanding of the implications of Leverage and how it can be effectively utilized. It is important to approach Leverage cautiously, implement proper risk management strategies, and stay informed about market trends.

Throughout this blog, we have emphasized that Leverage is a powerful tool that amplifies profits and losses. However, there are other paths to success or failure. Trading success relies on a combination of skills, knowledge, strategy, and disciplined execution.

It is vital to continue learning and seek guidance from reputable sources on risk management, trading strategies, market trends, etc.

We have also covered some other myths and misconceptions in our thread, which you can check out here.

Lastly, if you're looking for a seamless trading experience where you have full control over your coins, be sure to explore GooseFX. With GooseFX, you can access a wide range of decentralized financial products, including perpetual futures, NFT Aggregator, and more, while enjoying a secure and user-friendly platform.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()