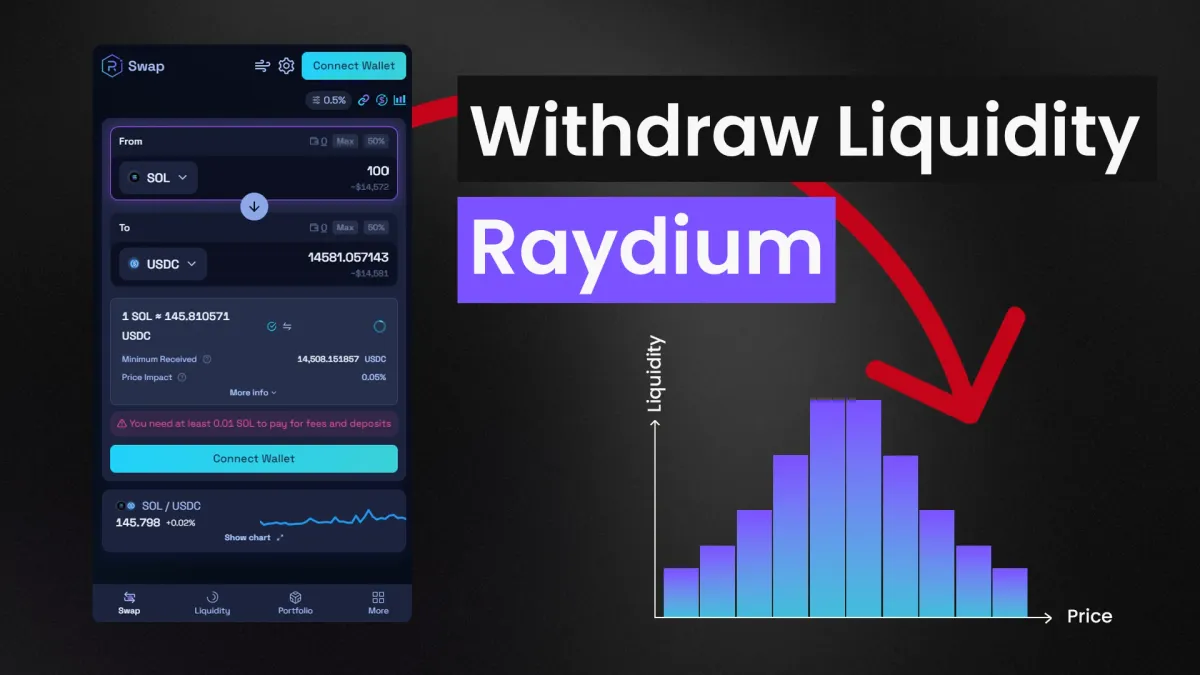

How to remove/withdraw Liquidity from Raydium

Learn how to add, withdraw / remove liquidity on Raydium.

Table of Content

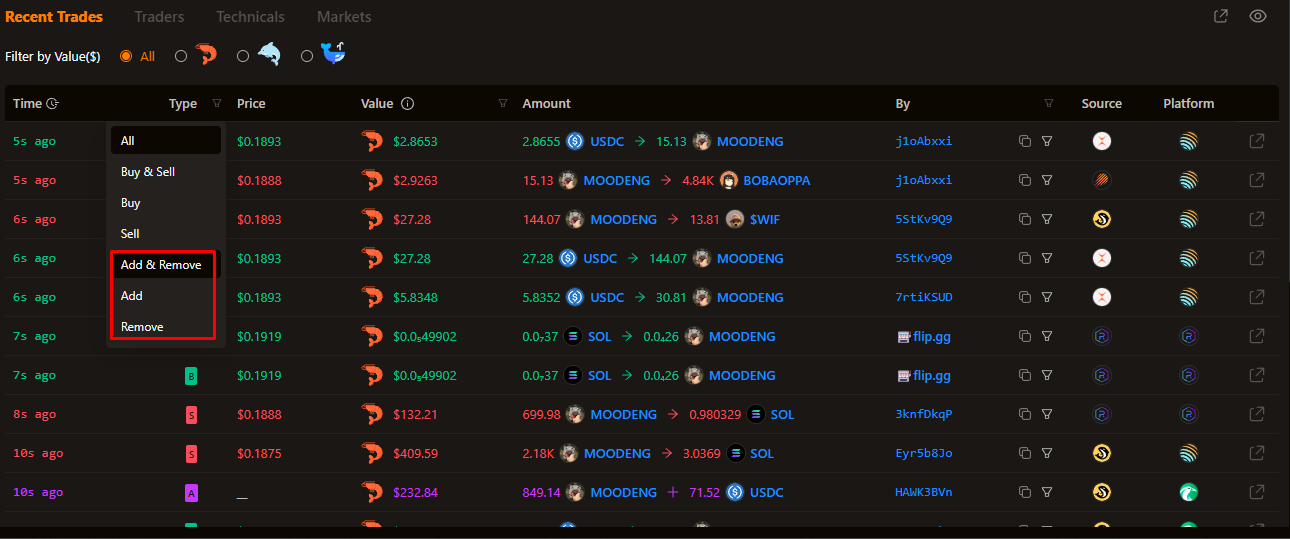

If you've been in the Solana trenches, every time you go on to Birdeye, you might have seen these weird filter trade types like "Add" or "Remove" or "Add and Remove". Well, these are in reference to adding or removing liquidity from the liquidity pools and in this blog, Lil goose is going to take you through what these are and how you can also add or withdraw liquidity for your favorite tokens.

Let's get started!

What are Liquidity Pools

First off for doing so, we'll need to understand what liquidity pools actually are. Well, as the name suggests these are nothing but pools... of liquidity. Traditionally, on centralized exchanges when a token is launched, you'll have people putting limit orders on both buy and sell sides thus creating an orderbook.

However, since AMMs don't have the concept of orderbooks, various users pool their money together which is known as a Liquidity Pool or LP against which, traders who want to swap their assets swap.

For example, in a SOL-USDC pool, 50% of the pool's value is in SOL, and 50% is in USDC. When a user wants to swap USDC for SOL, they’re trading directly against the liquidity in the pool, rather than against limit orders placed by other traders on an orderbook.

We've written a whole lot about this on our blog: CLOBs vs AMMs

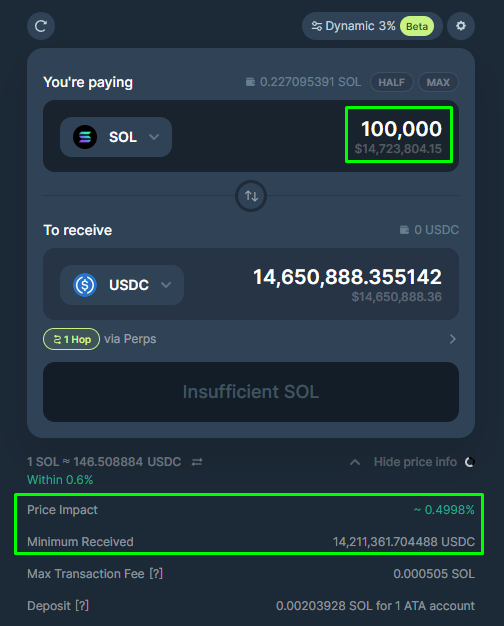

Having a large amount of liquidity in a liquidity pool is important for allowing the users to trade larger position sizes without having to worry about Slippage. Slippage occurs when you try to swap large amount of tokens relative to the pool's total liquidity significantly impacting the price at which the user gets swapped and thus, leading to potential losses and making the process capital inefficient.

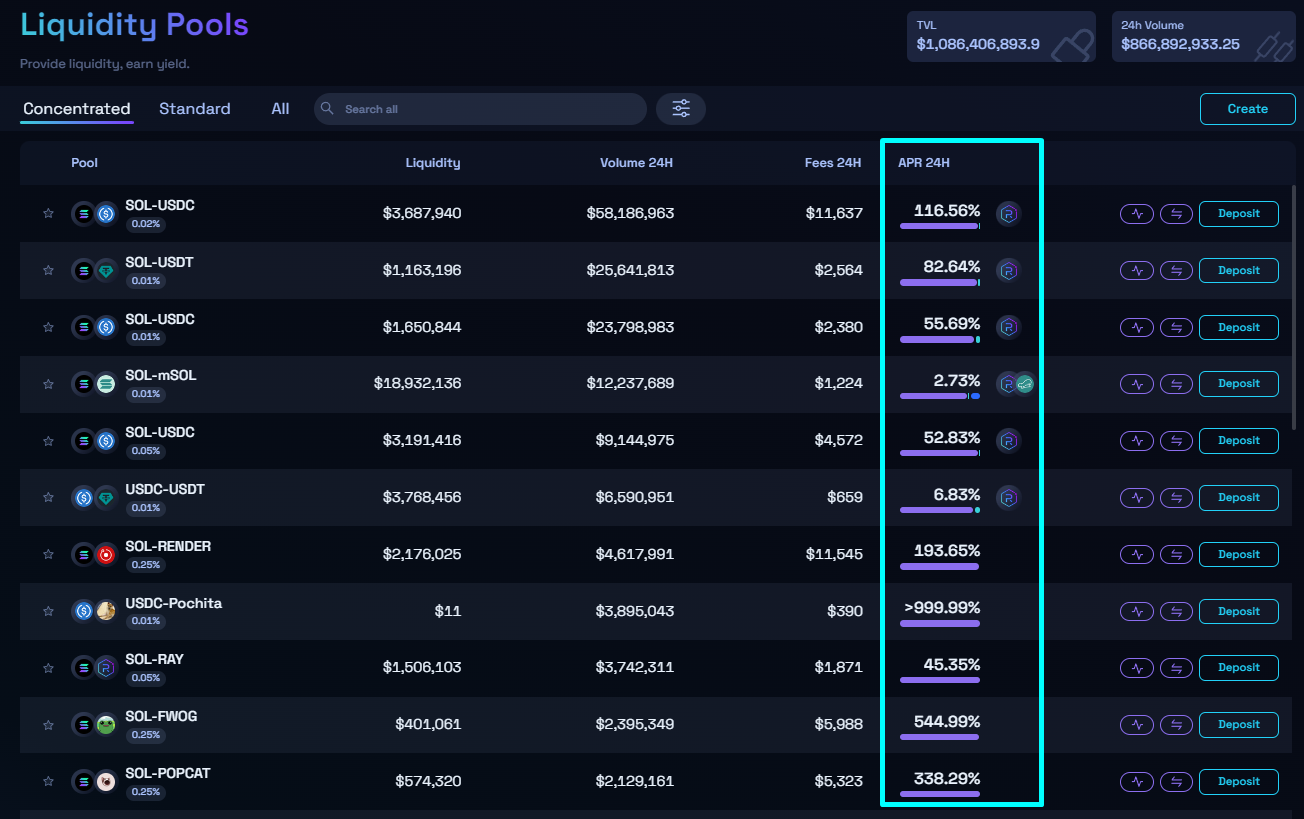

In return for adding liquidity in these pools, users or liquidity providers as they're known earn a portion of the fees generated on each swap thus earning yield on their deposits. This is known as Yield Farming.

How to add liquidity on Raydium

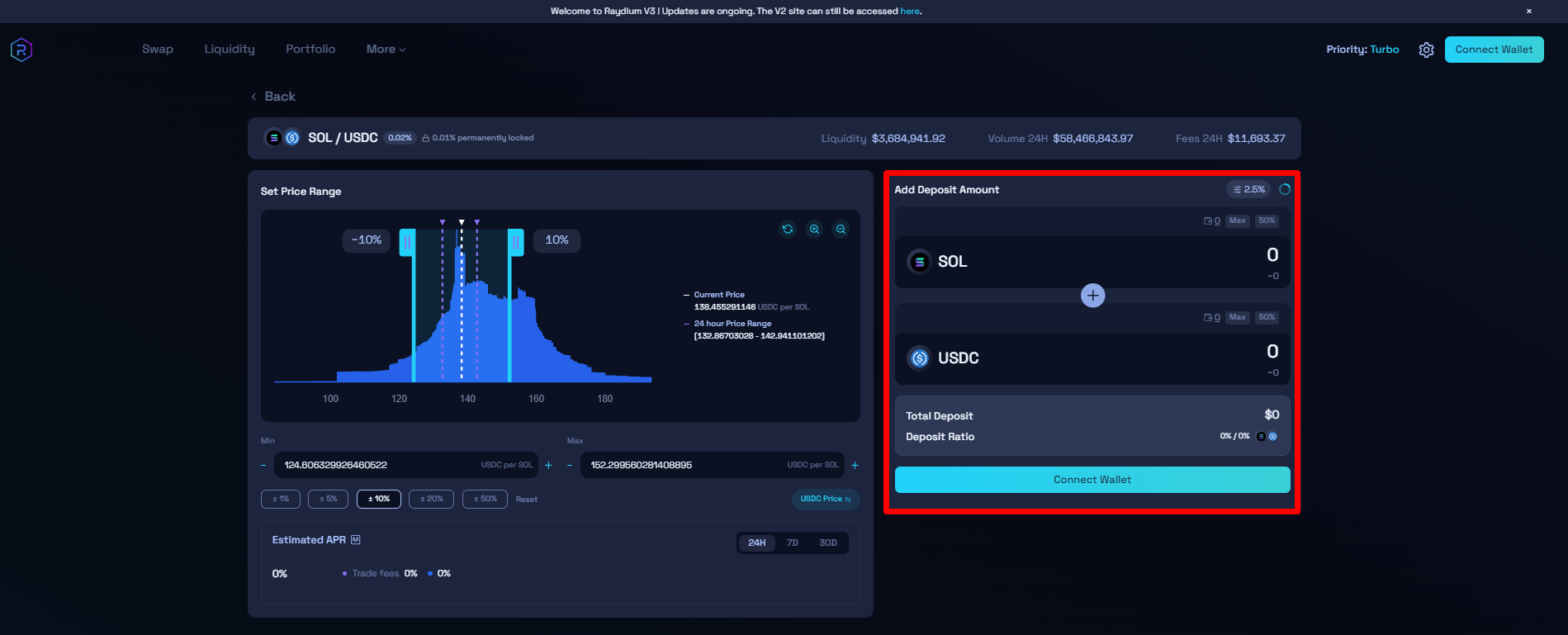

Now that we know the benefits of having a large liquidity pool both for the Liquidity Providers and for the users who want to swap their assets, let's understand how you can add liquidity. For this example, we'll be using Raydium and their Standard Liquidity Pools.

Concentrated or CLMM Pools are something that differ from traditional AMM pools. We've written an article to help you understand what they are and how you can add liquidity on these pools.

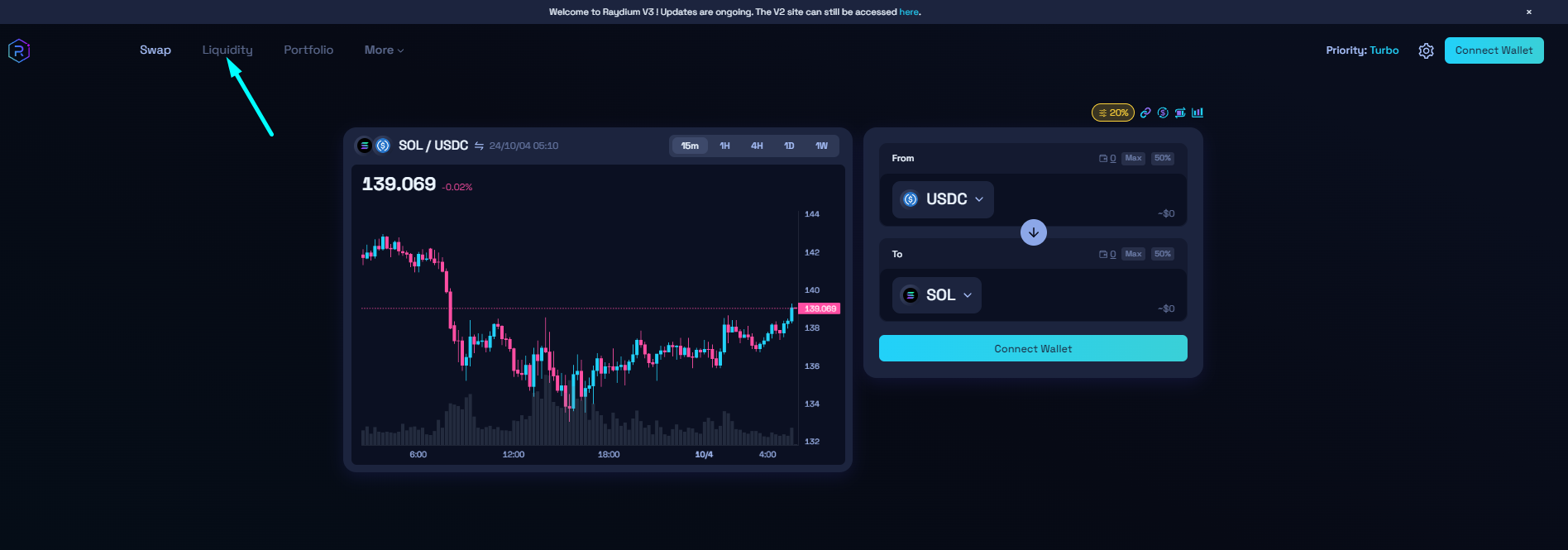

- Visit Raydium and head over to the Liquidity tab.

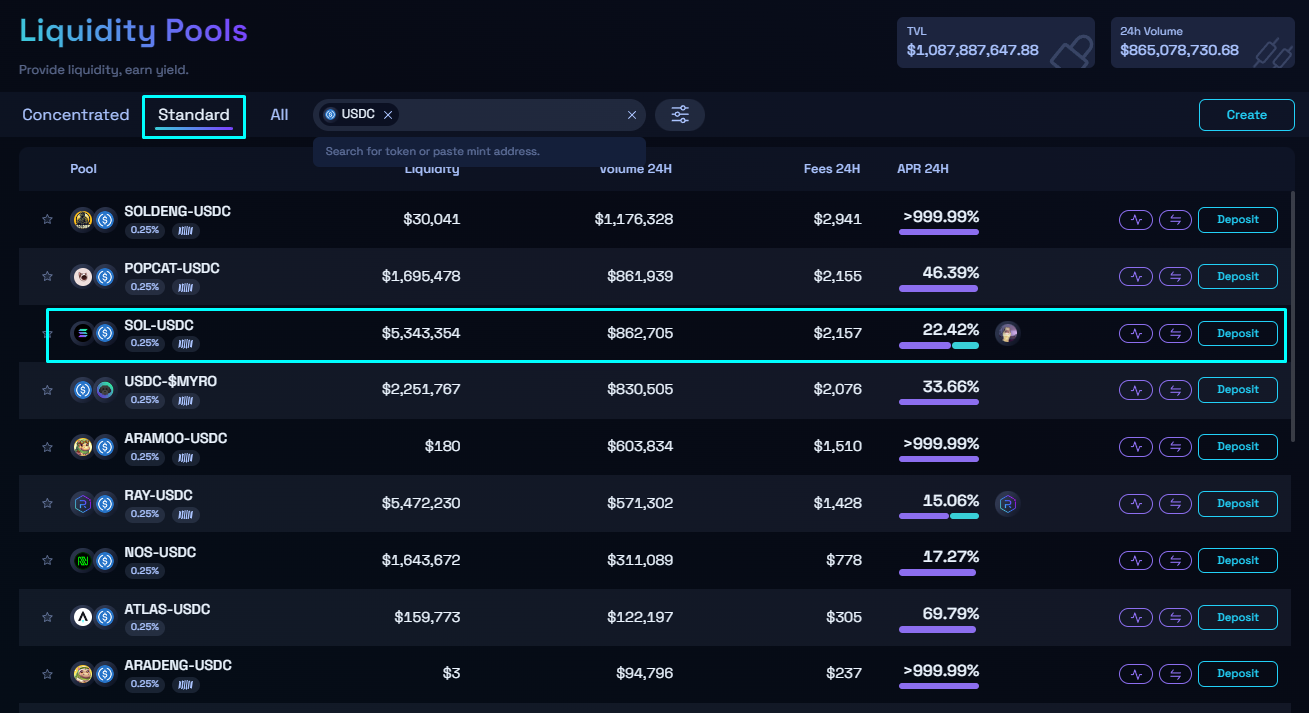

- Once you open the Liquidity section, go to the Standard pools and search the token or pool you'd like to add liquidity to. Let's assume for this example that I would like to add liquidity to SOL-USDC standard pool.

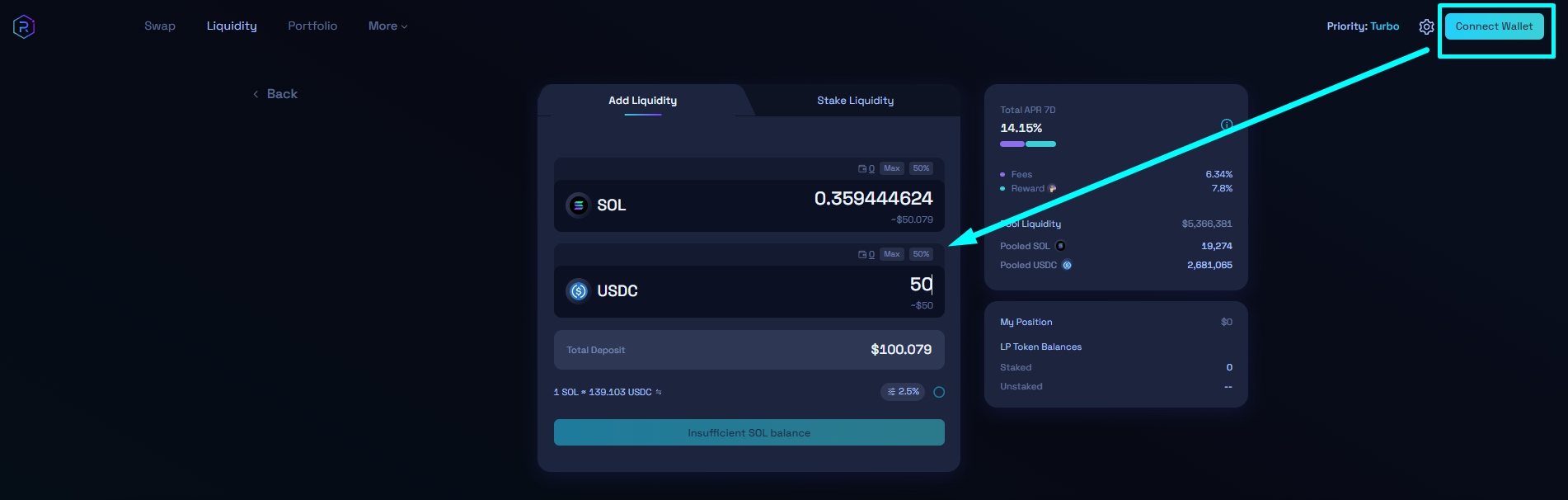

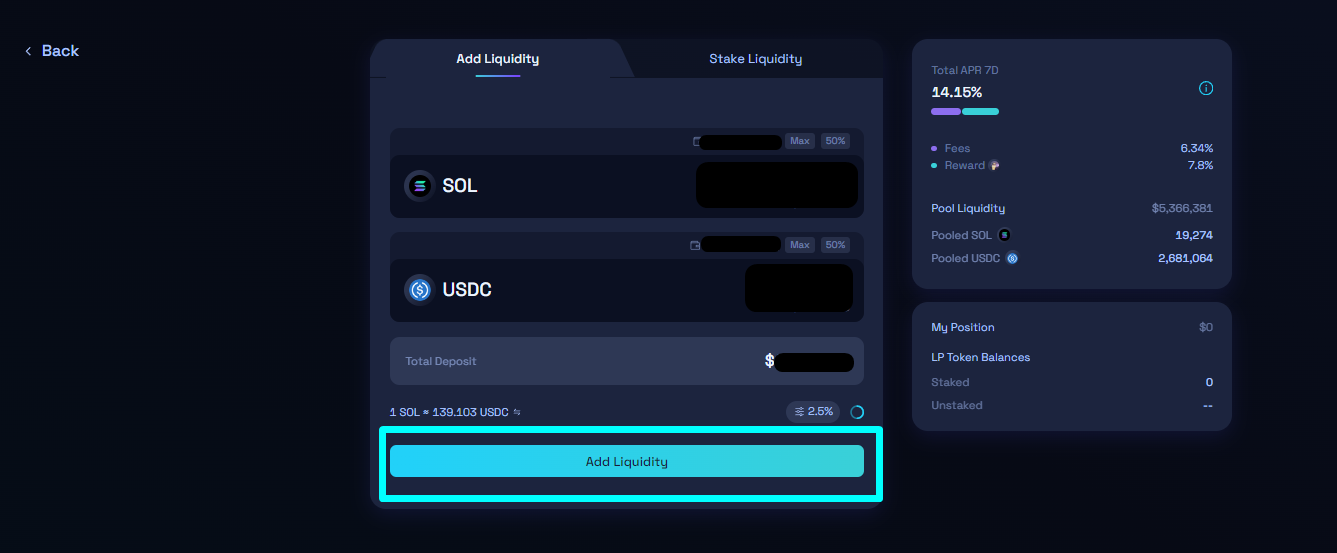

- Connect your wallet and select the amount of SOL or USDC you would like to add. Note that populating one of the two tokens will automatically populate the other token amount since the ratio should be 50/50 for them. So if I enter 50 USDC, it will auto-populate the amount of SOL required to add which would be equal to 50 USDC worth of SOL.

- Complete the transaction by clicking the "Add Liquidity" button and confirm the transaction on your wallet and you're all set now!

How to remove liquidity on Raydium

Once you've added liquidity there would come a time when you would like to cash all the gains earned by yield farming and thus you would want to remove liquidity. Removing liquidity follows a similar procedure with a few tweaks so let's jump right into it.

- To get started, visit the Portfolio section on Raydium

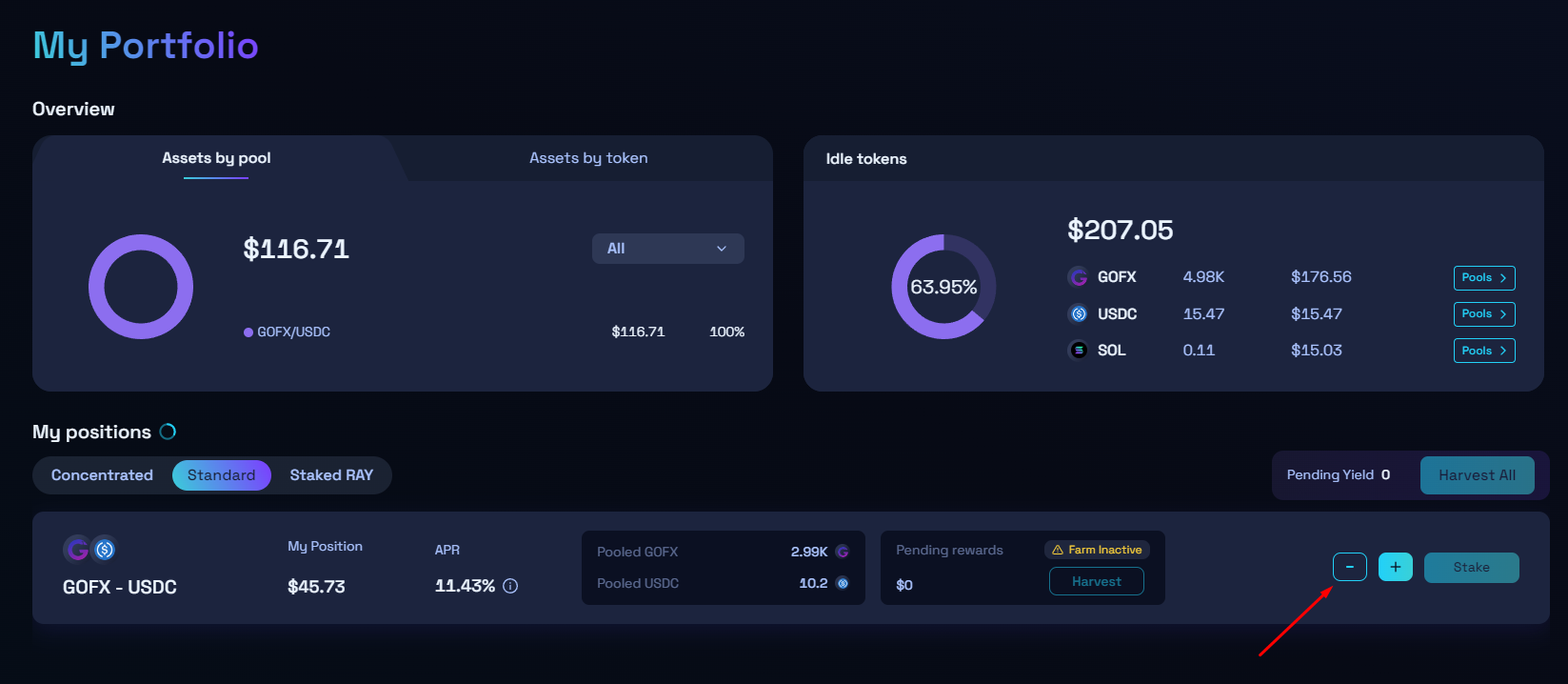

- Once you're there, switch over to the Standard tab in the "My Position" section where you should see your LP Position.

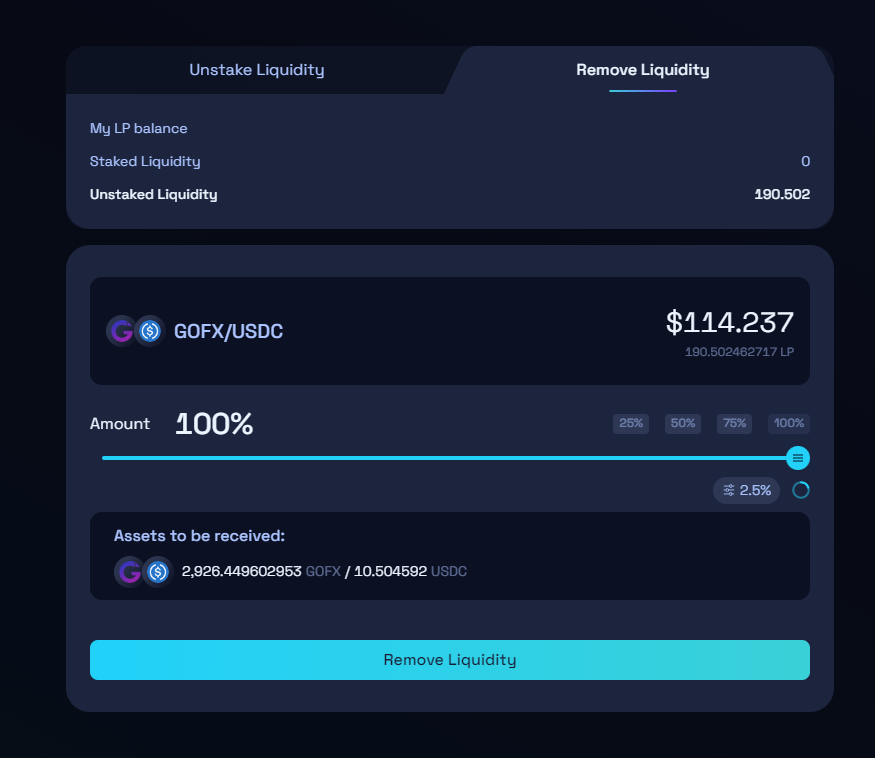

- Click on the "-" button and select the amount of tokens you'd like to withdraw. If you'd like to withdraw all of your liquidity, simply select the "Max" option

- Finally, click on withdraw which will open your wallet to confirm the transaction and voila, you've withdrawn liquidity from Raydium. The amount of tokens you get is based on the percentage of pool you hold and you'll get the tokens in the same 50/50 ratio.

If you have any doubts or queries, you can also visit Raydium's documentation highlighting everything about adding liquidity

Do note that there could be a discrepancy between the amount of tokens you'd put in and the amount of the two tokens you receive. For example, you could have put in 1 SOL and 140 USDC in however get 0.5 SOL and 200 USDC.

This is due to what we call, Impermanent Loss. Impermanent loss or IL for short is the difference in the USD value of tokens when they are held in a liquidity pool versus simply holding them in your wallet.

For more information on this, you should visit our article on Impermanent Loss

Note that, adding/removing liquidity is similar across all AMMs with dual-token standard pools thus if you want to add or remove liquidity on Meteora for example, the process would still be the same with the difference being in UI/UX.

Wrapping up

Entering the DeFi space inevitably involves interacting with Liquidity Pools and AMMs, making it essential to understand how they work. A key part of this is learning how to add and remove liquidity, as well as how to leverage these pools for yield farming.

However, as Lil Goose mentioned, it's equally important to be aware of the risks, particularly Impermanent Loss, and to consider strategies on how you can potentially maneuver around them and minimize the impact.

We've given a few ways how you can reduce Impermanent Loss in crypto that you should check out to get started!

Until next time, Happy farming

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()