GooseFX - July Update (2024)

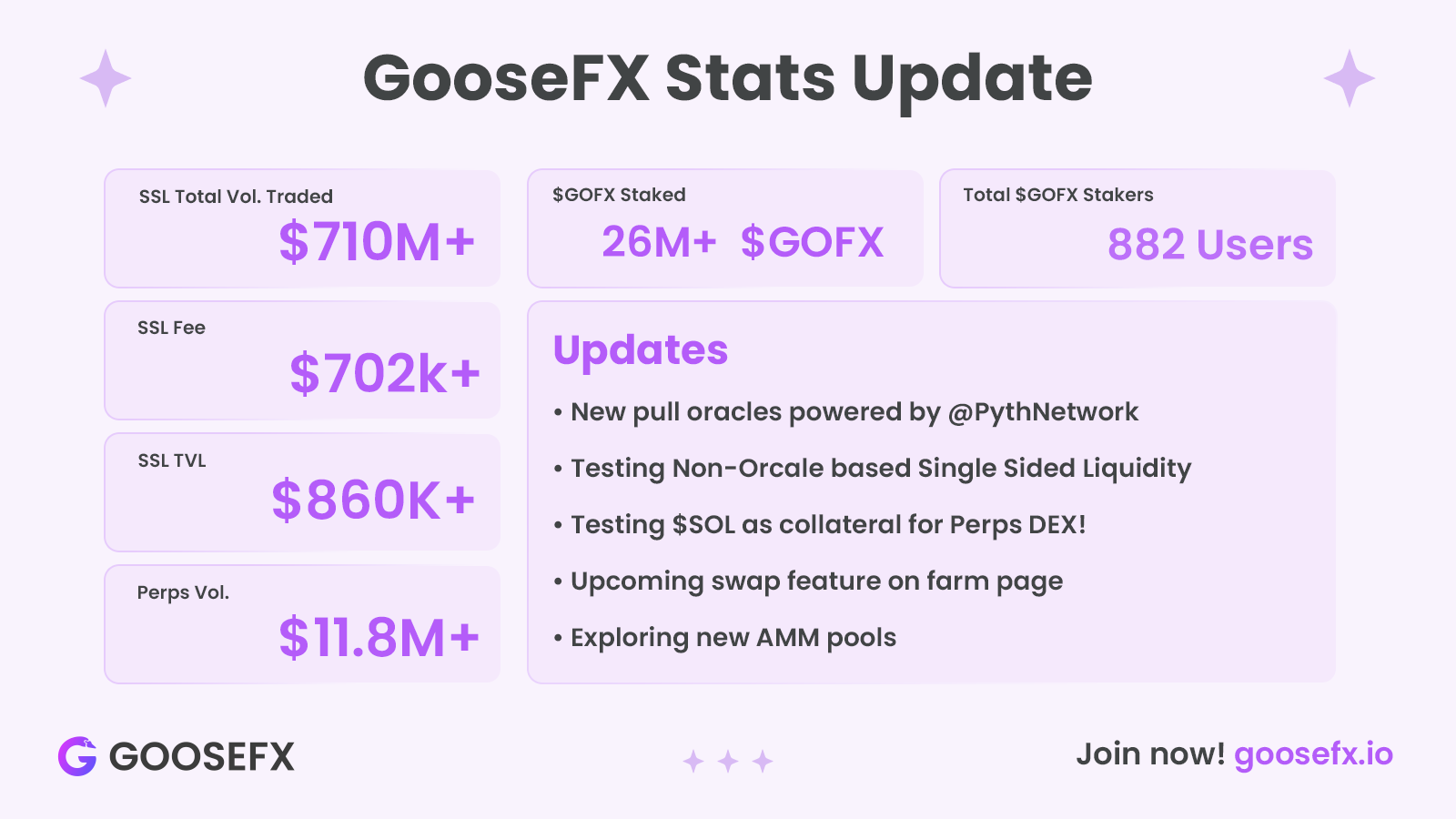

GooseFX marks over $710 million in volume and $702k+ in fees. With over 11.8M+ in Perps Volume!

A quick glance at our latest stats 🪿 #GooseGang

We achieved over $710,210,000 in trading volume and generating $702,100+ in fees. We now have over 26 million $GOFX staked by 882+ stakers, who are earning real yield in USDC!

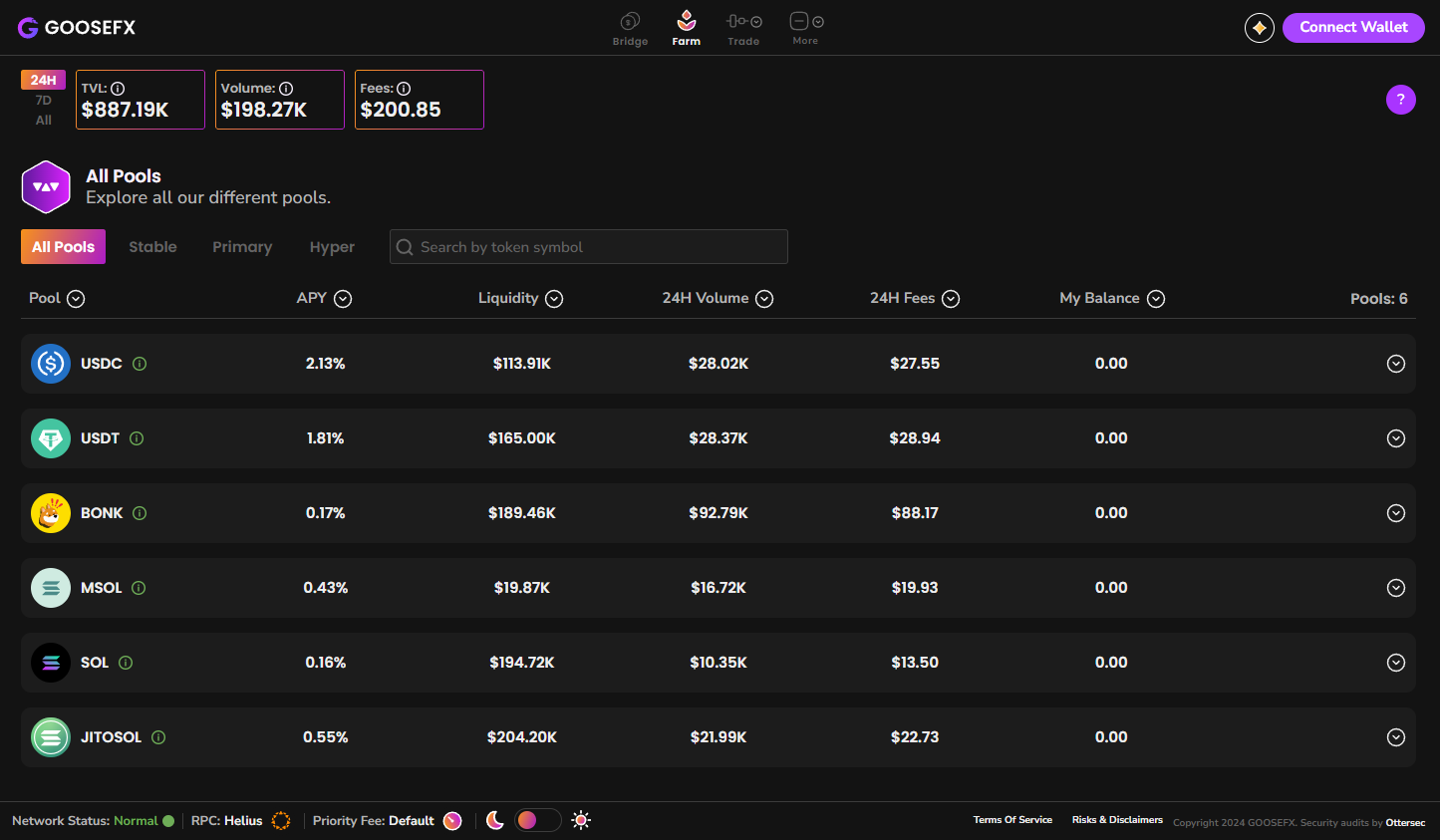

Single Sided Liquidity - SSL

We're committed to staying ahead of the curve, by leveraging Pyth Network’s new pull model. Goose Devs are proud to be among the first to build with Pyth’s new pull model achieving 10x lower latencies.

The latest algorithm model has been integrated, and we’ve identified a few blockers causing volume fluctuations. The Goose team is actively back-testing fixes and pushing the latest updates to ensure optimal performance.

Devs fixed a few edge cases causing deposit, claim, and withdrawal errors across our SSL Pools.

However, we ran into issues in two areas

- Volume Issues: Could be based on the original data source of Jupiter/Pyth data sourced from Dune.

- Back tester Bug: There may be a bug in our back tester affecting performance.

Our goal with Pyth pull was to get price updates much faster and not be limited by the speed of publishers who generally only post if there is a price change or in a few seconds. We require prices every 2 slots (0.8 seconds).

At one point, we were the second most frequent Pyth price updaters (first being the Pyth team themselves), which shows our commitment to achieving low latency. However, the high costs associated with oracle based model makes this an issue.

Now, we have immediately begun developing a non-oracle-based approach to SSL to see if we can still compete without them. You may ask why other protocols use oracles just fine and why it doesn’t work for us? Most protocols don’t require the 2 slots uptime that we do, and we are processing tens of thousands of transactions per day, if not more.

The best analogy would be that HFT firms require millisecond latency, and doing that on-chain even with Solana has proven to be difficult, especially with the congestion in the last few months.

While working on this, we’ve been working on adding new AMM pools to list new tokens, and even using Token2022 standard with an efficient 1-click permissionless pool system. More on that later.

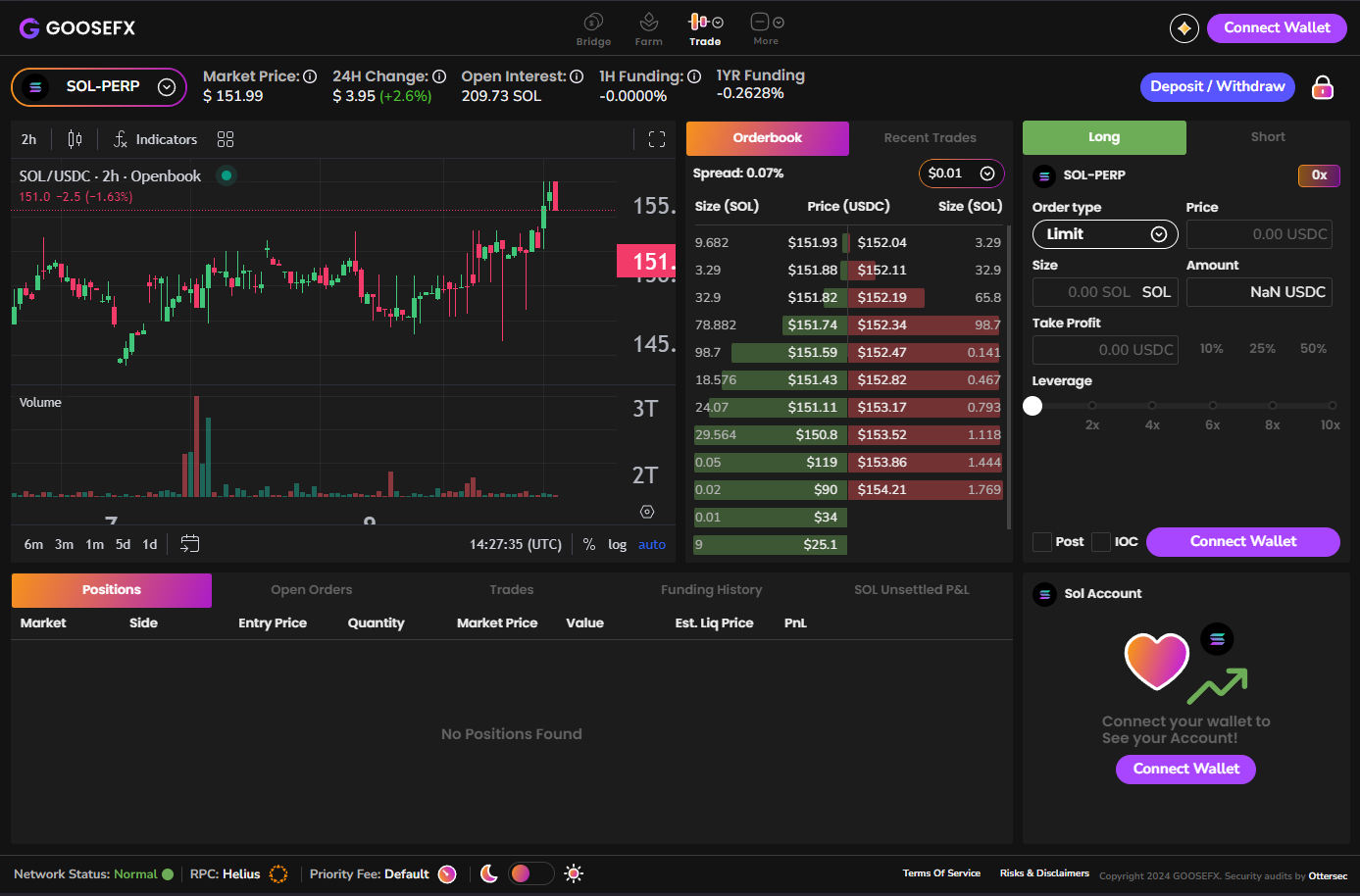

GooseFX Perpetuals DEX

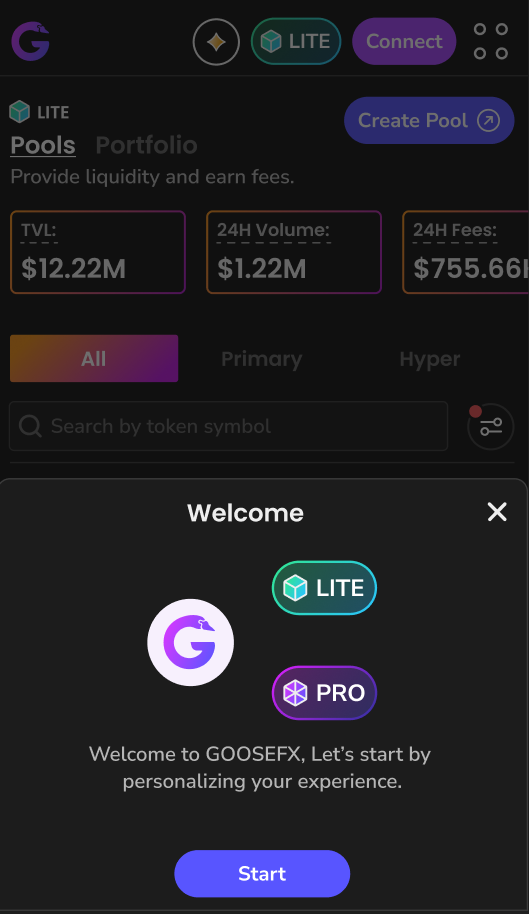

We rolled out significant updates on our Perps DEX, focusing on user experience and adding new features.

We've overhauled our Perps DEX desktop interface to make it more user-friendly, especially for those new to perpetuals and leverage trading.

Multi-Collateral Support

Soon, you will be able to deposit tokens other than USDC as collateral, allowing you to leverage assets like SOL without selling them, thereby maximizing capital efficiency for trading. Although still in the alpha stage, we are making rapid progress.

Alpha 🤫

- An upcoming feature on our farm page will allow you to swap tokens at the best rate possible.

- Our SSL farm will handle the routing for these swaps, ensuring you get the best deal.

Blogs of the month

Dive into DEXs and AMMs called Liquidity Pools. Understand how they work, terms like slippage and impermanent loss and ways to deal with them.

Understand what slippage is and how to manage it is essential for maximizing your trading performance and minimizing losses.

Understand the difference between spot and perps trading and learn the best places to trade these on Solana.

Wrapping up

- We achieved over $710,210,000 in trading volume and generated $702,100+ in fees. Over 26 million $GOFX staked by 882+ stakers earning real yield in USDC.

- Devs leveraging Pyth Network’s new pull model for 10x lower latencies

- Testing new AMM pools to list new tokens, and even using Token2022 standard with an efficient 1-click permissionless pool system.

- Introducing multi-collateral design for GooseFX Perps DEX and an enhanced desktop UI.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()