Expected Value(EV) and RR

This blog explores expected value in finance, explains its use in forecasting outcomes, diff. btw. EV & risk-reward, provides examples of positive/negative EV, tips to improve EV in trading incl. risk management & backtesting.

Table of content

- Introduction

- What is Expected Value or EV?

- Some basic Examples

- Ways to improve the EV of your strategy or system

- Conclusion

Introduction

So, a tweet from a famous anon on Twitter called CryptoCred, got Lil Goose thinking about how people still can’t differentiate between RR and EV and understand things from an EV or Expected Value standpoint. In this article, Lil goose will be going over what is EV and how to improve it for your trading strategies.

Risk:Reward is overrated and is often used as a crutch for bad ideas.

— Cred (@CryptoCred) February 2, 2023

Just because you moved the reward tool far enough to meet some arbitrary number doesn't mean the setup is good.

"I'm gonna play a set vs Djokovic. If I win, I get $100. If he wins, I lose $50. Good R:R!"

So, without any further ado, let’s dive into it!

What is EV?

The expected value is a crucial idea in probability theory with extensive applications in economics, finance, and statistics.

It represents the average result somebody can anticipate from specific events. This concept enables us to forecast the expected outcome of a particular situation, which can assist in making informed choices, i.e., trading (and not gambling)

In simpler terms, EV is the submission of each outcome of an event multiplied by the probability of that outcome happening.

You can think of it as Frequency(Probability of X happening) * Magnitude(Outcome)

How is it different from RR?

Expected value and Risk-Reward are two distinct concepts in finance and economics used to evaluate potential outcomes. EV represents the average result somebody can expect from a given set of outcomes or events. At the same time, RR measures the potential Reward versus the associated risk of a particular investment or decision.

So, the next time you see someone posting a 20 RR trade (i.e., the Reward is 20 times the Risk), don’t get flabbergasted because they could still be negative EV.

Now, that we know what EV is, what does a positive or a negative or even zero EV mean?

A positive EV indicates that the average outcome is expected to be profitable over an infinite period, while a negative EV suggests that the average outcome is expected to result in a loss. Lastly, zero EV simply means that your system is neither profitable nor a loser over an infinite period of time.

Let’s understand this better by taking a few basic examples!

Examples

Now let’s start by taking a basic example of a dice. For any number X that it lands on, you get $X; i.e., if it lands on four, you get $4!

We know that the probability of any side on a dice is ⅙; hence the EV or expected value of this would be:

(⅙*1) + (⅙*2) + (⅙*3) + (⅙*4) + (⅙*5) + (⅙*6) = 7/2 or 3.5

It implies that if you roll the dice an infinite number of times, you’ll get an average of $3.5 per roll.

Now, let’s spice it up a bit more and say that if you roll a 6, you lose $6!

Hence the outcome of you getting a six is -$6 and not $6, and so the EV equation now becomes:

(⅙*1) + (⅙*2) + (⅙*3) + (⅙*4) + (⅙*5) + (⅙*(-6)) = 3/2 or $1.5

Hence you see that the EV has now drastically changed!

With all this out of the way, let us apply the same thing to a trading system. In this we only have two major outcomes. Either you win or you lose.

So, assume you have a strategy that has a Win Rate of 70%, and you risk losing $20, and your Reward is $50 for this trade.

Hence the EV for this trade would be:

(0.750) + (0.3(-20)) = $29,

implying that if you trade this strategy, you’ll earn $29 per trade on average over an infinite period.

You can also calculate this in the form of RR. For the same case, we have an RR of 50/20 = 2.5. So if you win, you’ll gain 2.5 RR; if you lose, you’ll lose 1RR.

Hence, the EV would be:

(0.72.5) + (0.3(-1)) = 1.45 RR.

Since 1R = $20 , 1.45RR would then be = 1.45*20 = $29!

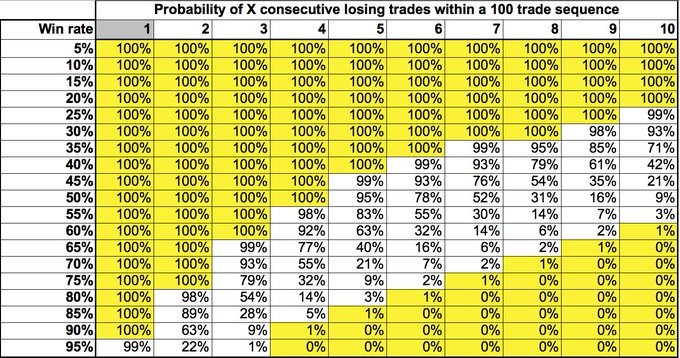

This is an easy cheat sheet to see your breakeven Win Rate and if your strategy has a WR greater than that then it means your strategy is +EV!

Ways to improve the EV of your trading system

There are several ways to improve the EV of your system.

- Risk Management: Managing risk through stop-loss orders and position sizing can help minimize the negative impact of losing trades on the expected value.

- Lucky Entries and Likely Exits: A phrase by the well-known red pepper SalsaTekila is one of the best ways to improve your EV but not the easiest.

Why I prefer buying dips when bullish, or selling rips when bearish. pic.twitter.com/qGG8GHtkDC

— SalsaTekila (@SalsaTekila) October 8, 2021

Lil Goose urges you to read the whole thread if you have time!

- Backtesting: Regularly backtesting the trading strategy can help to identify areas for improvement and add new conditions to the system accordingly.

- Continuous Learning: Like backtesting results in better EV over time, learning new things and concepts can also help minimize your losses and maximize your gains, thus leading to an increase in EV.

Conclusion

Expected Value or EV is a fundamental idea in probability theory with a wide range of applications in finance, economics, and statistics. It represents the average result that somebody can anticipate from a set of events or outcomes with a positive EV, meaning that the average outcome is expected to be profitable over an infinite period, while a negative EV implies that the average outcome is expected to result in a loss.

This concept is vital in understanding and improving your trading systems and strategies. There are several ways to improve the EV of your system, including but not exclusive to effective risk management, lucky entries and likely exits, and regular backtesting of the trading strategy. The goal is to maximize the positive impact of winning trades and minimize the negative impact of losing trades on the overall expected value.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

![Top 6 Chart Patterns for Crypto Trading [Guide]](/content/images/size/w720/2024/07/Top-trading-patterns.png)

Comments ()