A look into Derivatives and Structured Products in Solana

"Explore the world of derivatives and structured products on Solana's blockchain. Learn how these financial instruments can be used to manage risk and gain exposure to new markets.

Table of Content

Introduction

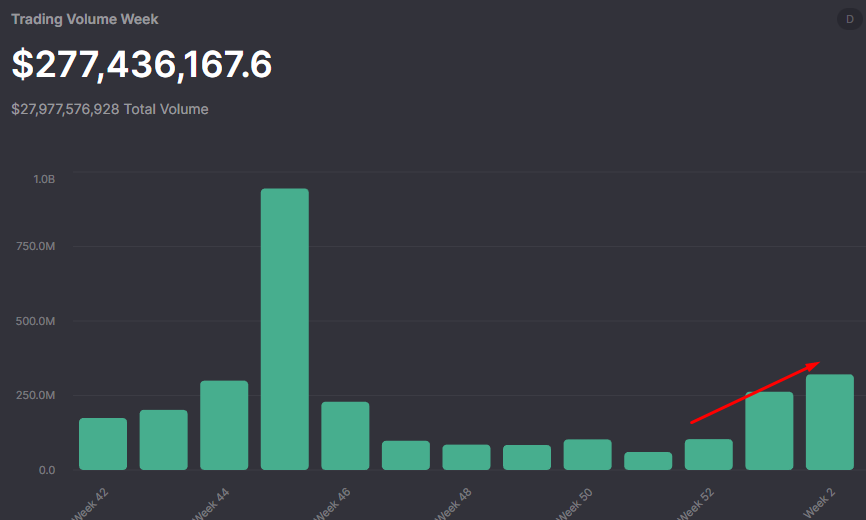

The Solana ecosystem has seen significant growth recently, becoming a popular choice for DeFi projects. Despite the setback caused by the collapse of FTX, the introduction of Openbook and BONK, along with the community's efforts to bring back liquidity, has led to a rise in trading volume and total value locked in the past few weeks.

One area that has seen significant development and growth in volume is trading protocols. Solana's high-performance and low-cost infrastructure make it an ideal spot for trading, whether it's derivatives or spot.

An anon on Twitter who goes by the username of MoonOverlord sums it up very nicely

When you finally “get” $sol it’s a zero to one moment

— moon (@MoonOverlord) January 4, 2023

There’s no other chain this is possible onpic.twitter.com/6I1Upt7AVq

Derivatives are financial contracts that derive their value from an underlying asset and are used to manage risk and speculate on future market movements.

You can check out our blog on this topic in detail here.

With all that out of the way, this blog will cover and explore the current state of derivatives in the Solana ecosystem. We will look at the existing derivatives and synthetic derivatives products and platforms in Solana, analyze the volume and liquidity of derivatives in the ecosystem, and discuss the opportunities in the Solana derivatives market.

As discussed in our bi-weekly market update, the sentiment regarding Solana and the ecosystem, in general, is shifting as a whole. You can see from the trading volume done on Jupiter that it increased three times its initial volume.

Solana has seen many Derivatives protocols opening up, providing users with various contracts from perpetual futures to synthetic derivatives and vaults.

Let's take a look into each of the categories!

Perpetual Futures

Before its collapse, Mango Markets were the primary exchange for perpetual trading futures, followed by Drift Protocol and Zeta Markets.

However, On October 11, Avraham Eisenberg engaged in a series of actions to artificially raise the value of the Mango (MNGO) token. As a result of these actions, the individual could profit from the increase in value by borrowing $116 million using the unrealized profits as collateral and then withdrawing these funds from Mango Markets. This market manipulation ultimately led to the individual's arrest.

We charged Avraham Eisenberg with manipulating the MNGO token, a so-called governance token offered and sold as a security on the crypto platform Mango Markets. Eisenberg is in federal prison awaiting transport to NYC on parallel criminal charges.https://t.co/gn0Xf00NkJ

— U.S. Securities and Exchange Commission (@SECGov) January 20, 2023

Along with the collapse of FTX resulted in Mango Markets not being functional anymore and would be building on top of Openbook and releasing the v4 Version of their protocol.

I'll be hosting a Mango dev call in discord on Sunday at 9pm UTC. Many things to discuss including the progress of v4, funding for Mango Labs and the app. Bringing back the good old times

— daffy (@dadadadaffy) January 21, 2023

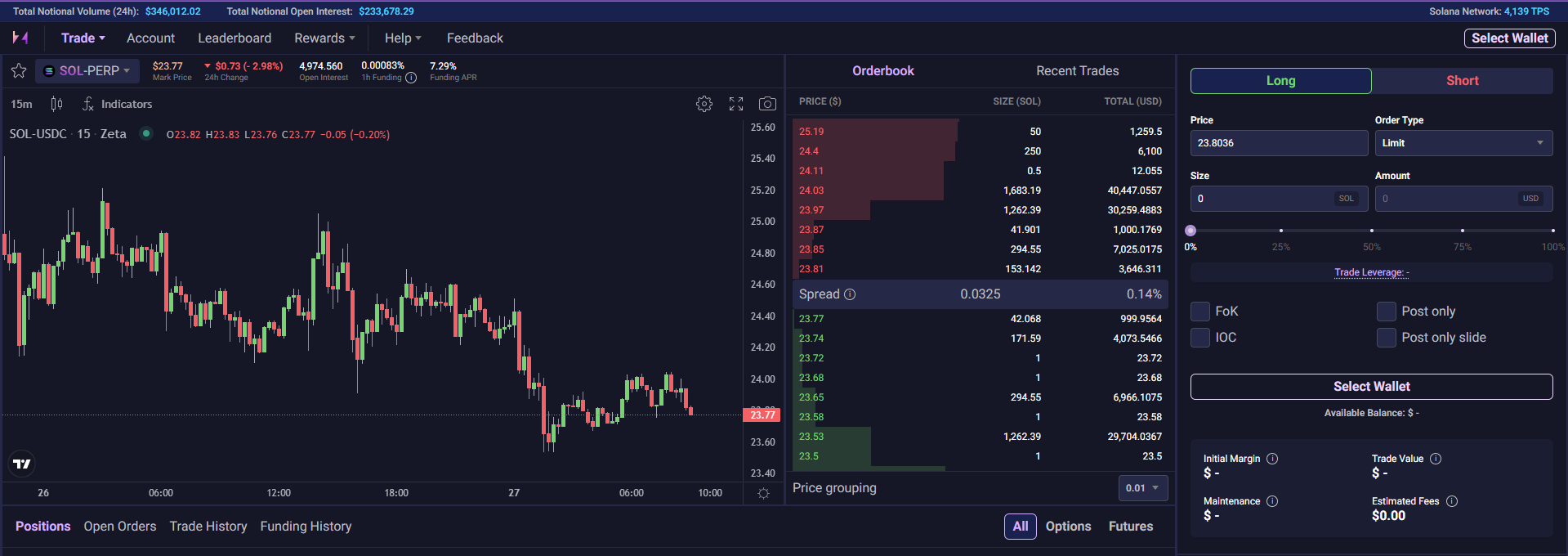

Currently, Drift Protocol is doing a 24H volume of over $1.1 Million, while Zeta Markets, which launched their revamped DEX a few months back, is doing a 24H volume of over $150,000.

These protocols offer three markets; BTC, ETH, and SOL, with varying leverage going as high as 10x on Drift protocol for BTC and ETH Perps.

For those of you who don't know, Drift Protocol is a decentralized exchange on Solana that offers spot trading, perpetual trading, borrowing and lending, and liquidity provision. Three liquidity mechanisms support trades on Drift: Just-in-Time (JIT) Auction Liquidity provided by market makers, Limit Order Book Liquidity provided by its decentralized orderbook, and AMM Liquidity provided by its Automated Market Maker (AMM). It ensures that trades are executed efficiently with low slippage, low fees, and minimal price impact.

You can read more about it in their documentation.

While Zeta Markets is a DeFi derivatives platform that aims to democratize derivatives trading by providing liquid, under-collateralized derivatives options and futures trading to individuals and institutions alike. The platform offers two core products, DEX, a decentralized derivatives exchange, and FLEX, an option minting and auctioning infra layer that enables any protocol to leverage options. Their mission is to simplify the derivatives trading experience and enable anyone to hedge, speculate, and take opinions on a limitless variety of market movements.

Options, Structured Products, and Asset Management protocols

We are seeing an increase in the number of protocols offering synthetic derivatives and other structured products like fund management platforms on Solana.

For those who aren't familiar with it, Synthetic Derivatives are financial contracts constructed by using a combination of other derivatives or assets to imitate the behavior of a particular underlying asset.

Protocols such as Friktion, PsyOptions, Katana, and Dual Finance offer multiple vaults (or volts in the case of Friktion) or structured products that are a mix of options and futures to provide maximum yield while having downside protection.

Let's take a brief look into a few of these!

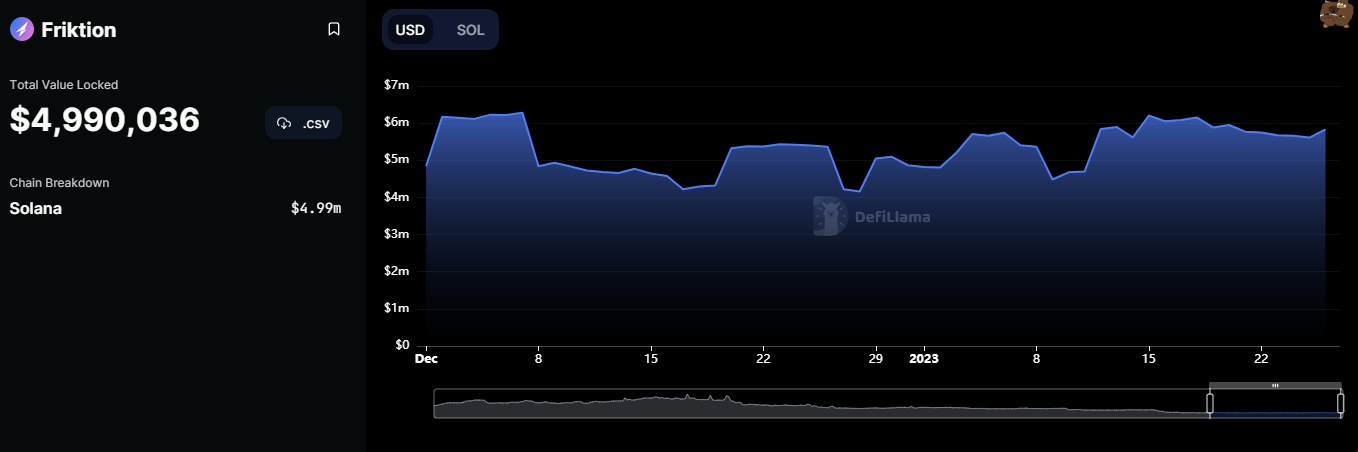

Friktion is a decentralized platform for portfolio management. It offers Volts native portfolio strategies for users to generate passive returns based on their risk appetite. Circuits, a custom risk framework, is used for DAO treasury management. Friktion allows building portfolios that generate returns in different market conditions, with options for directional views or market-neutral strategies.

Update: As of January 27, 2023, Friktion Labs has decided to sunset its user platform. You can read all about it here

PsyOptions is a decentralized, community-owned financial services platform that aims to bring traditional finance to feel to the DeFi space. It offers a variety of options trading protocols and aims to become the go-to on-chain financial services platform for DeFi users. Its product suite includes options strategies, market making, leveraged products, and lending.

All of these protocols combined have seen a rise in trading volume as new users realize the unique offerings of these protocols in helping earn yield even during bear markets by either selling covered calls or shorting volatility etc.

Apart from PsyOptions and a revamped HxroLabs which is a derivatives platform for risk-based applications, we also have Cega Finance, which offers slightly different options on its platform. Such options are called Exotic Options which you can read about here.

Cega Finance has achieved a steady Total Value Locked of around 17.5 million USD across its six different vaults. The vaults of Cega Finance have been designed to cater to different risk appetites and investment strategies, making it an attractive option for a wide range of users. The diversity of these vaults has also helped to ensure that the protocol can maintain its steady TVL, even in a market known for its volatility, providing users with a sustainable yield over time.

Conclusion

Solana's high-performance and low-cost infrastructure have made it an attractive option for trading derivatives and synthetic derivatives products.

We have seen a rise in trading volume on protocols such as Drift Protocol and Zeta Markets, and an increase in the number of protocols that offer synthetic derivatives and other forms of structured products like fund management platforms on Solana. These protocols, such as Friktion, PsyOptions, Katana, and Dual Finance, offer unique offerings that help users earn yield even during bear markets. The diversity of these vaults has also helped provide users with a sustainable yield over time.

The Solana ecosystem has a lot of potential in the DeFi space and should likely continue to see growth and development in the derivatives market.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()