World of DeFi: APR vs APY

Maximize your DeFi returns by understanding APR and APY. Discover how these metrics shape your yield farming strategy with GooseFX's detailed blog.

Introduction

Welcome back to another blog in this World of DeFi series! Building upon our previous discussion on yield farming, we are diving deeper into a crucial topic: APR vs APY. In our previous blog, we briefly touched upon these concepts, and now it's time to expand our knowledge and explore them in greater detail.

For those wanting a brief, Yield farming refers to earning rewards by staking or lending your tokens in DeFi protocols. Examples of such protocols are Raydium, Orca, Kamino, and us at GooseFX with our SSL Pools v2.

Without any further ado, let's jump into our blog with the basics out of the way!

What are APR and APY?

When engaging with different yield farming protocols, you may have observed using two distinct terms to describe returns: annual percentage yield (APY) and annual percentage return (APR). These terms are often used interchangeably but have distinct meanings and implications.

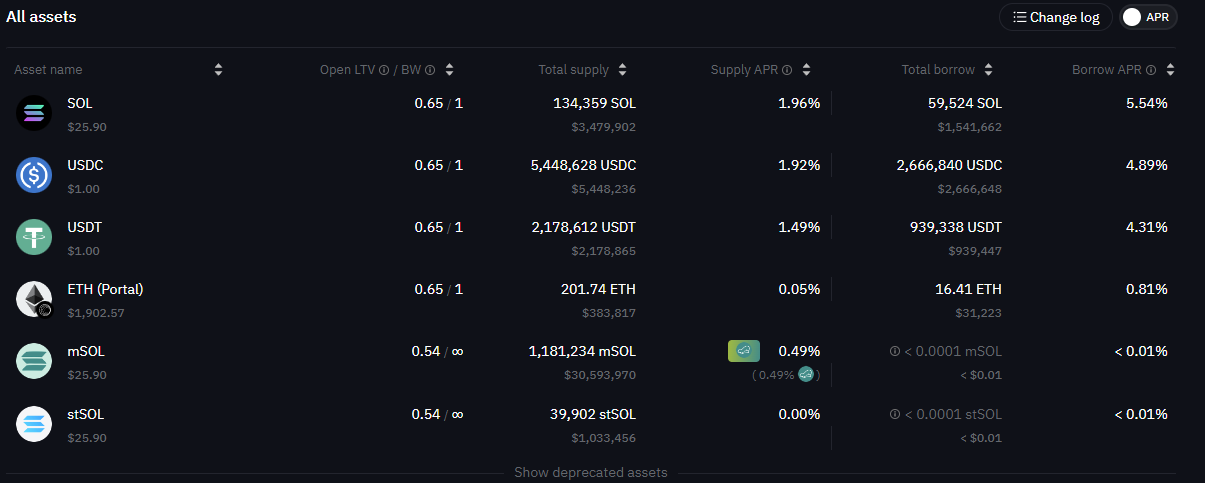

APR, or Annual Percentage Rate, represents the annualized rate of return on investment. It considers the annual interest earned, providing a standardized metric for comparing different investment options. For example, Lending platforms like Solend or Lido generally display the APR to borrowers to help them understand the cost of borrowing.

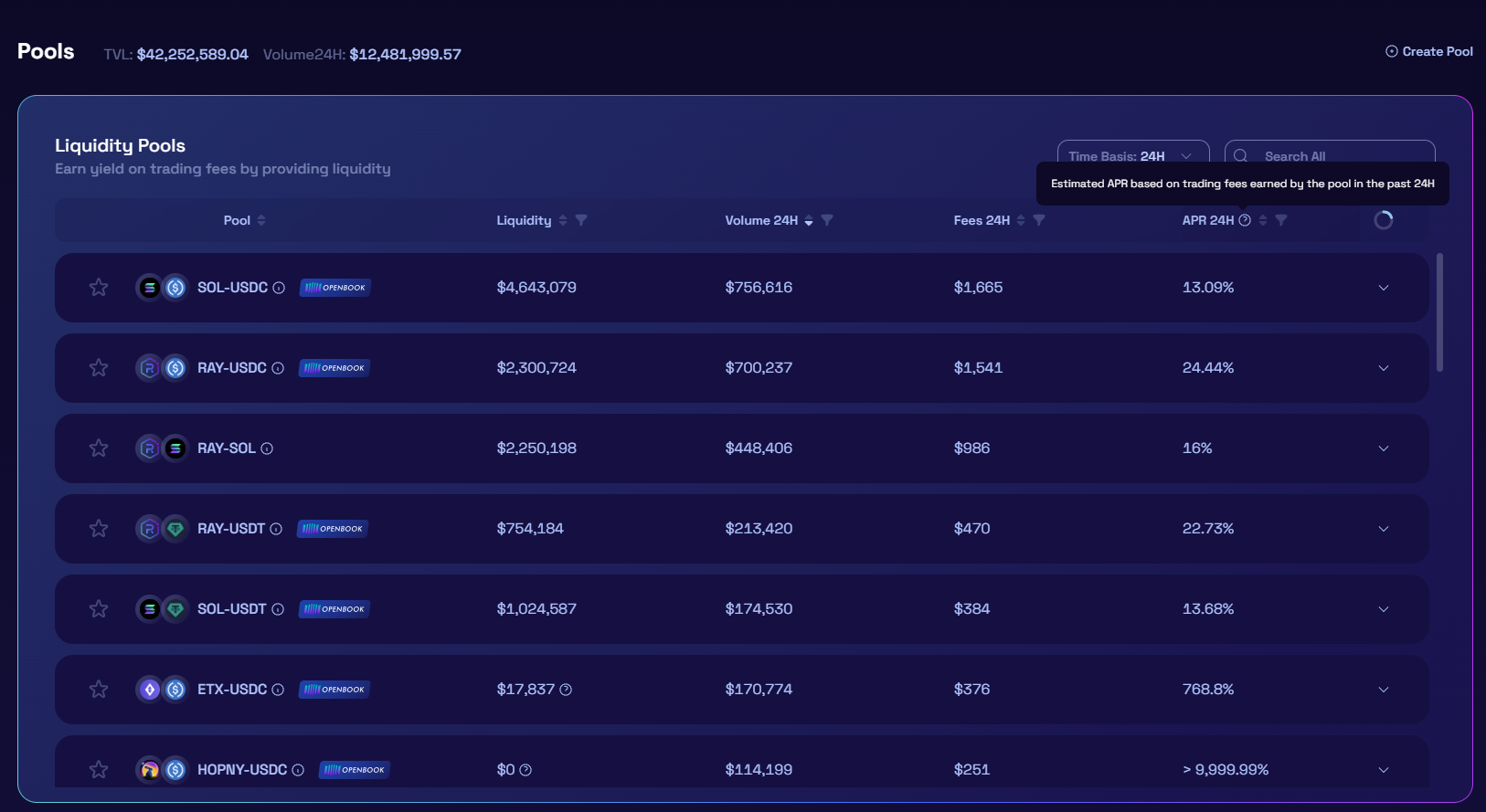

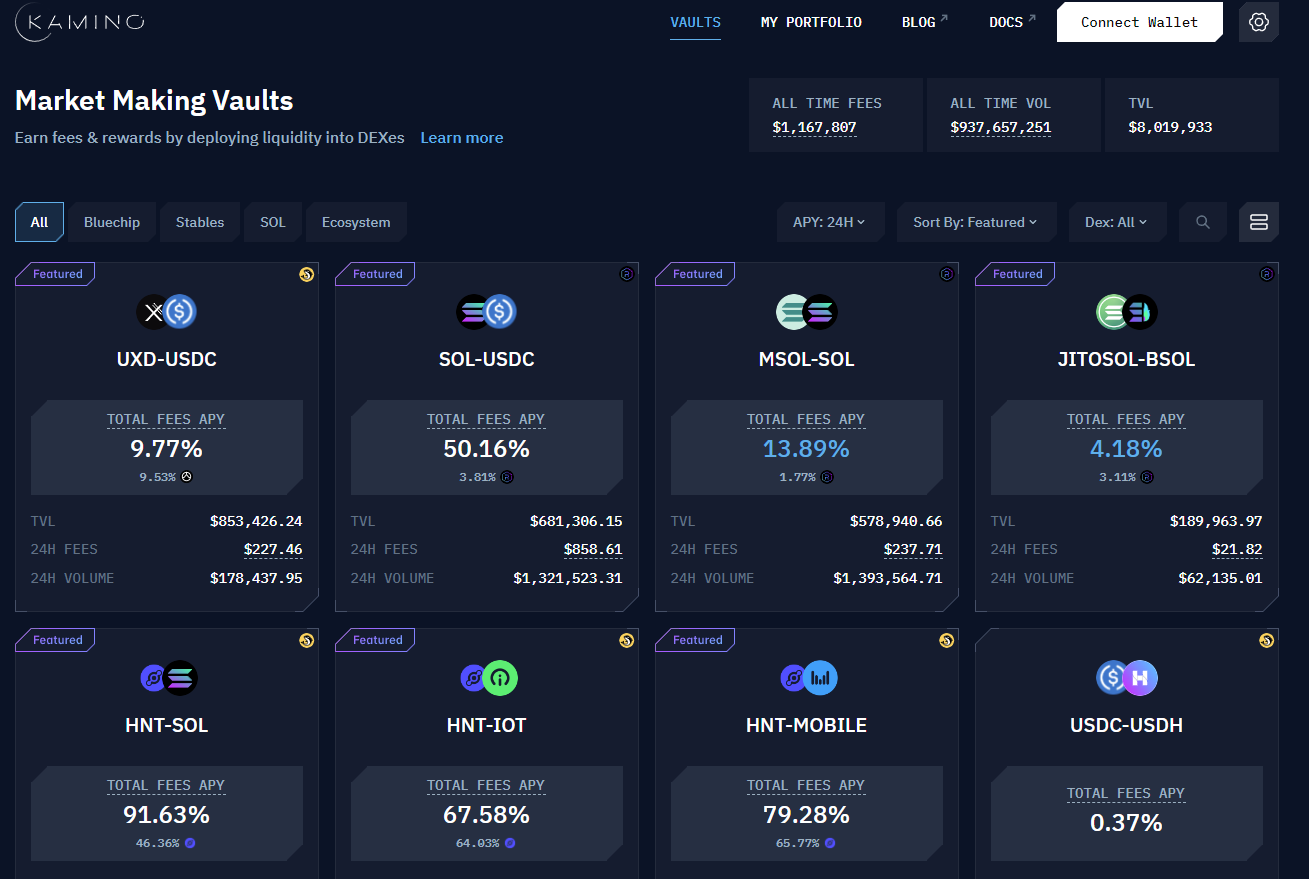

On the other hand, APY, or Annual Percentage Yield, measures the total return on an investment, including the effect of compounding interest. APY factors in the interest earned and the frequency at which it is compounded, giving a more accurate representation of the investment's growth over time. For instance, in liquidity pools like Orca or Kamino, the APY indicates the estimated annualized return that liquidity providers can earn by providing their assets to the pool and earning trading fees and rewards.

It is important to note that APY is typically higher than APR due to compounding effects. As a result, APY showcases the potential for wealth accumulation and serves as a valuable metric for assessing the performance of investment products.

Key Differences

Compounding

APR does not consider compounding, and assumes a simple interest calculation while APY accounts for compounding, considering how frequently interest is added to the investment.

Effect of Fees

APR generally doesn't include any upfront fees or costs associated with the loan or investment. It provides a standardized measure to compare different financial products. APY incorporates the impact of fees into the overall return, enabling a more accurate assessment of the investment's performance.

Nature of Yield

APR represents the nominal interest rate, which may not reflect the actual yield due to the absence of compounding. APY provides a more realistic yield by considering compounding, giving a clearer picture of the investment's performance.

Calculating APR and APY

When determining the APR and APY, understanding the calculation methods is crucial.

Calculating APR involves a straightforward process. It requires considering the interest rate charged or earned and adjusting it to an annualized rate. To calculate APR, follow these steps:

- Determine the periodic interest rate: If the interest is compounded monthly, divide the annual interest rate by 12. For quarterly compounding, divide it by 4.

- Multiply the periodic interest rate by the number of compounding periods in a year. It will give you the annual interest rate.

- Convert the annual interest rate into a percentage to obtain the APR.

The APR for a duration of T days would look like:

APR = (Interest / Principal) x (365 / T) x 100

Calculating APY is slightly more complex, as it incorporates the effects of compounding.

To calculate APY, follow these steps:

- Convert the nominal interest rate into a decimal.

- Determine the number of compounding periods yearly (e.g., 12 for monthly compounding).

- Raise the result of (1 + r/n) to the power of "n."

- Subtract 1 from the result and multiply by 100 to obtain the APY as a percentage.

The formula for APY is as follows:

APY = [(1 + r/n)^n ] - 1

Where:

- "r" represents the nominal interest rate.

- "n" denotes the number of compounding periods in a year.

Frequently Asked Questions (FAQ):

Is a higher APR or APY better?

A: The answer depends on the context. A lower APR is preferable for borrowing as it indicates lower borrowing costs. Conversely, a higher APY is desirable for savings or investments as it signifies greater potential returns.

Why is APR higher than APY?

A: APR does not consider the compounding effect, while APY accounts for compounding. As a result, APR appears lower because it represents the nominal interest rate without considering the impact of compounding.

How is APR calculated?

A: APR is calculated by considering the total borrowing costs over a year, including interest, fees, and other charges. It provides a standardized measure to compare borrowing costs across different loan products.

What is the difference between APR and APY?

A: The main difference between APR and APY lies in their applications and the inclusion of compounding. APR is used for borrowing, while APY is relevant to savings and investments. Additionally, APR does not account for compounding, while APY reflects the impact of compounding on returns.

What is the difference between interest rate and APY?

A: The interest rate represents the cost of borrowing or the return on savings, while APY refers explicitly to the annualized yield considering the compounding effect. The interest rate is a component of both APR and APY calculations.

Conclusion

APR and APY are vital in understanding the cost and returns associated with different yield farming protocols. By comprehending their differences and implications, you can navigate the world of yield farming more effectively.

In case you decide to invest a significant portion of your capital into yield farming, it's essential to research the protocols you're using and consider splitting your capital among multiple protocols as a healthy risk management practice. Armed with insights from GooseFX, you can harness the power of APR and APY to optimize your yield farming strategy and unlock the full potential of your investments.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()